The bull-run is well and truly underway. Buckle up, because we’re in for a wild ride of violent price action, generational wins and a market set to rip to all time highs.

In this article, we want to:

- Explain key bull catalysts,

- Describe the hottest sectors,

- speculate on lurking risks and

- Provide some price predictions.

Bull Catalysts

Underlying this bull-run are three core factors, all converging to create the strongest tailwinds the industry has seen in years.

- Crashing Interest Rates: Trump’s recent (contested) firing of Fed governor Lisa Cook is a sign the administration is eager to install loyalists who will slash rates. Low rates are generally good for business which is important ahead of next year’s midterms. In particular, investors flock to riskier trades since holding funds in bonds is less appealing. Crypto, along with AI and tech stocks, will be big winners from this macro shift.

- Administration Alignment: The Trump Family is heavily invested in crypto and keen to profit on it. Of note are Donald Trump Jr’s recent 8 figure investment into Polymarket, the family’s $5 billion of holdings of WLFI and $TRUMP coin mania. The president has prominently labelled himself “the crypto president”; you can’t get any more obvious than that.

Other members of the administration are also aligned. Commerce Secretary Howard Lutknik’s son, Brandon Lutknik, is partnering with Softbank and Tether to create 21 Capital, a Bitcoin acquisition vehicle (i.e. DAT). Further, Republican mega donor Peter Thiel, founder of Palantir, has heavy holdings in crypto exchange Bullish as well as ETH treasury companies Bitmine and ETHZilla.

Over the last 4 years, the major concern for crypto was regulatory. Now, we have an (heavily conflicted) administration actively bull posting. One of, if not the, greatest barriers to parabolic adoption has all but evaporated, so expect big things from this.

- DATs: Digital asset treasuries like MicroStrategy for BTC have become the leverage engines of this cycle. By issuing debt and using the proceeds to buy up, they create a reflexive flywheel to up their NAV. This allows them to raise more debt, which fuels more buying and so forth. In the last 4 months, DATs have bought up almost 4% of the entire ETH supply and currently show no sign of stopping. Such a significant force on the buy side coupled with the above conditions will create a very strong headwind for ETH and BTC over the next 6 months.

Growth and Catalysts

So who will be the big winners of this cycle?

Top of the list are stablecoins, especially after the passing of the GENIUS Act. For more detail, see Sean’s article.

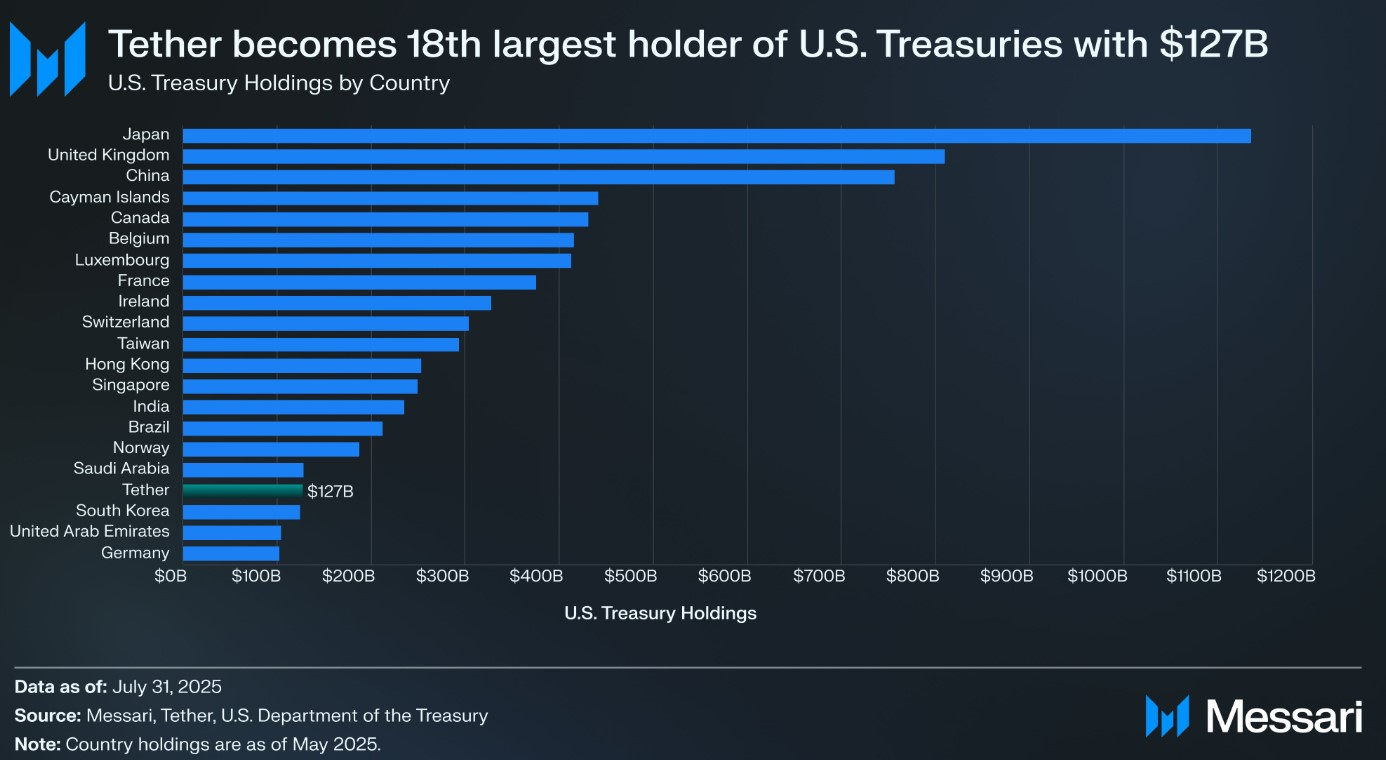

The US is setting the stage for USD stablecoins to be an ever growing holder of government debt. Currently, the stablecoin market sits at $280 billion with Tether the largest at $127 billion. Recent projections from Coinbase expect this increase by more than 400% by 2028 to $1.2 trillion.

This explosive growth would cement stablecoins as one of the largest buyers of U.S. Treasuries, ahead of nations states like South Korea and Germany. This will effectively turn such issuers into a new pillar of dollar demand. In doing so, they not only deepen crypto’s integration with traditional finance but also reshape global capital flows around digital dollars while providing the US government with another source of (cheap!) debt to draw from.

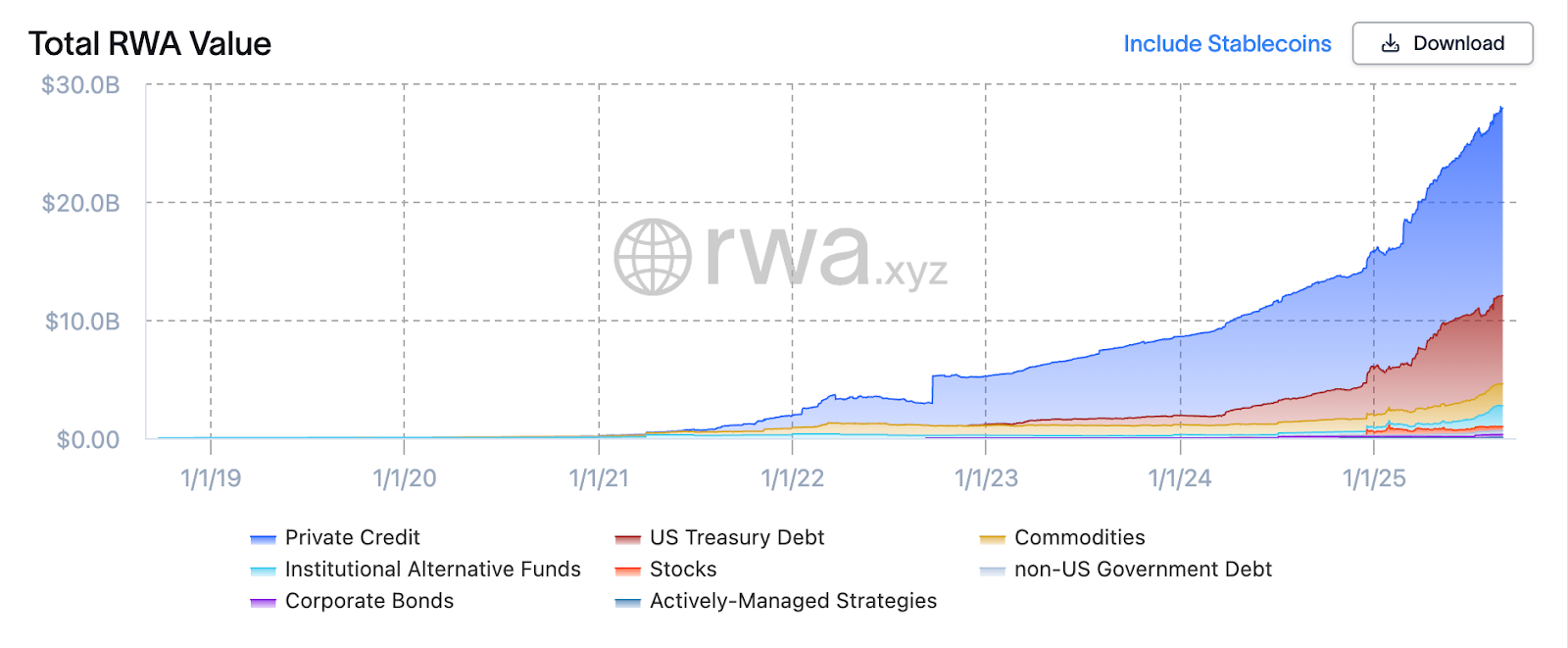

Despite almost doubling in total value since the start of the year (to just shy of $30 billion), real world assets (RWAs) excluding stablecoin are yet to have their time in the Sun.

The majority of this (~$16 billion, 53%) is from private credit, of which $11.6 billion (72.5%) is from Figure, a lending platform which allows users to borrow FIAT against their ETH and BTC holdings at a fixed rate. With a growing retail user base eager to hold onto their digital assets while accessing liquidity for home purchases and bill payments, it’s fair to expect platforms like Figure, as well as competitors Strike and Mezo to see massive growth this cycle.

Treasuries, the second largest RWA class, make up $7.5 billion of value. As Figure 2 below shows, the rate of growth of this asset class has been slowing recently, possibly due to forecasted rate cuts. In other words: why tokenize treasuries when their yield is about to compress?

So for RWAs this cycle, private credit for retail (and institutional, e.g. Maple) is probably going to be the big winner; tokenized treasuries (and for that matter, stocks) seem destined to take a back seat (for now).

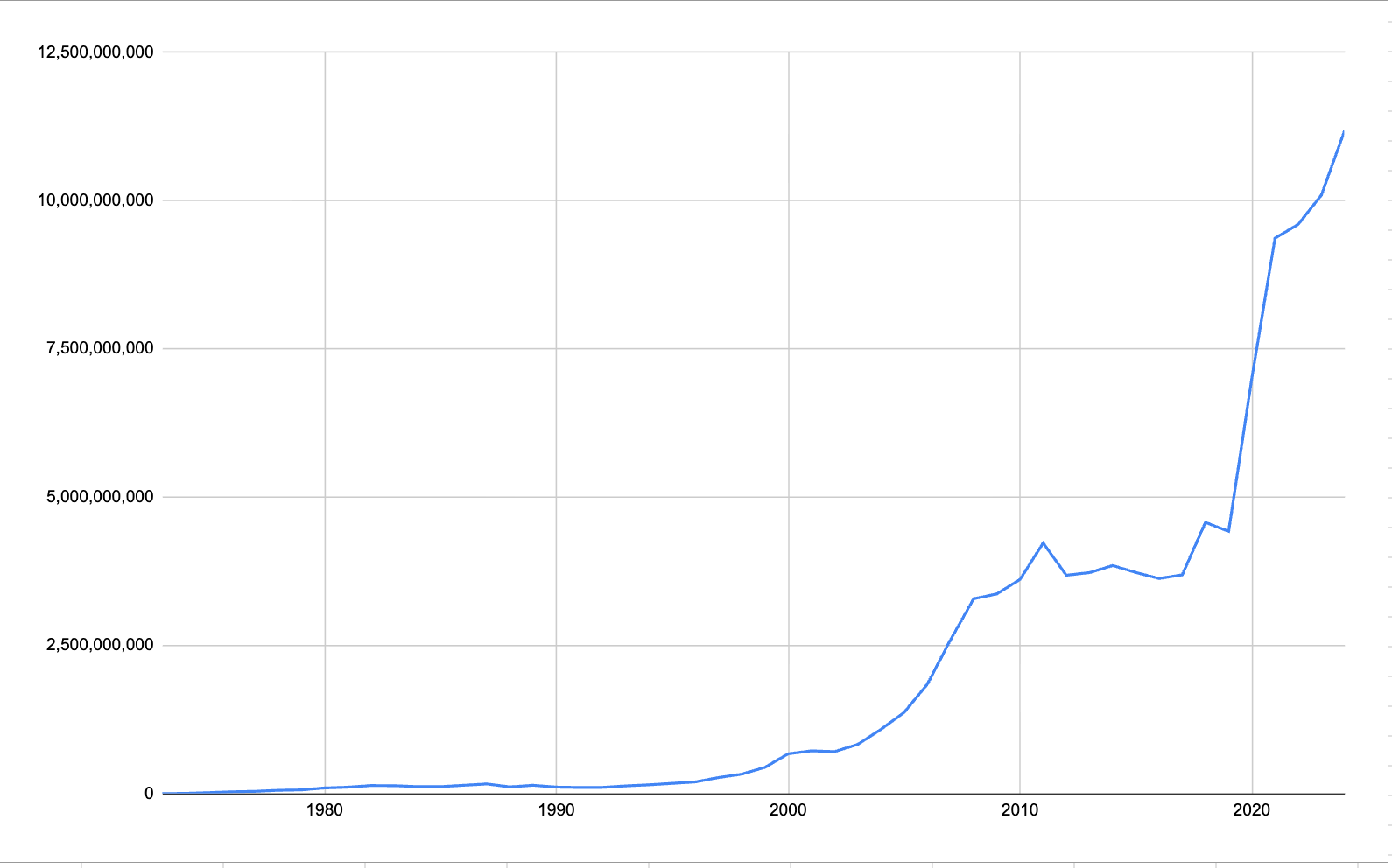

Finally, derivatives (options) have to be mentioned. As Figure 3 shows, annual option volumes in the traditional space have exploded over the last two decades as per the OCC, rising to more than 11 billion contracts today. As crypto matures, this same dynamic will repeat itself as institutional players seek out efficient hedging tools, structured yield strategies, and more liquid ways to express market views.

We can also expect to see altcoin options emerge, opening up hedging and speculative tools across the long tail of tokens. First to come will be the “secondary majors” like SOL and XRP, but by the end of the cycle we could see significant volume for options on HYPE/UNI/AAVE.

Danger Zone

So what can spoil this party? Broadly, we see two main risks.

First is a feedback loop when DATs begin trading at a multiple of their NAV < 1 (i.e. mNAV < 1).

Many of these companies like MicroStrategy (MSTR) raise funds by selling convertible bonds; i.e. by borrowing. Instead of paying interest on these loans, MSTR will instead give call options to lenders. The key worry is that if MSTR volatility drops, the value of these options drops too, making it more difficult for MSTR to raise funds.

This is compounded by the fact that there are so many DATs (for both ETH and BTC) doing similar things, i.e. offering a regulatorily smooth pathway to access crypto. Eventually, this over supply, coupled with unfavourable price action could see these companies trade at mNAV < 1.

This creates an arbitrage opportunity where it’s advantageous for the DAT to buy back its own stock by selling its crypto, further depressing both prices and mNAV for other DATs, creating a negative feedback loop and definitely not great for any prospective bull run.

The second major risk is a correction in the broader market, currently buoyed by the AI revolution, prematurely ending the bullrun.

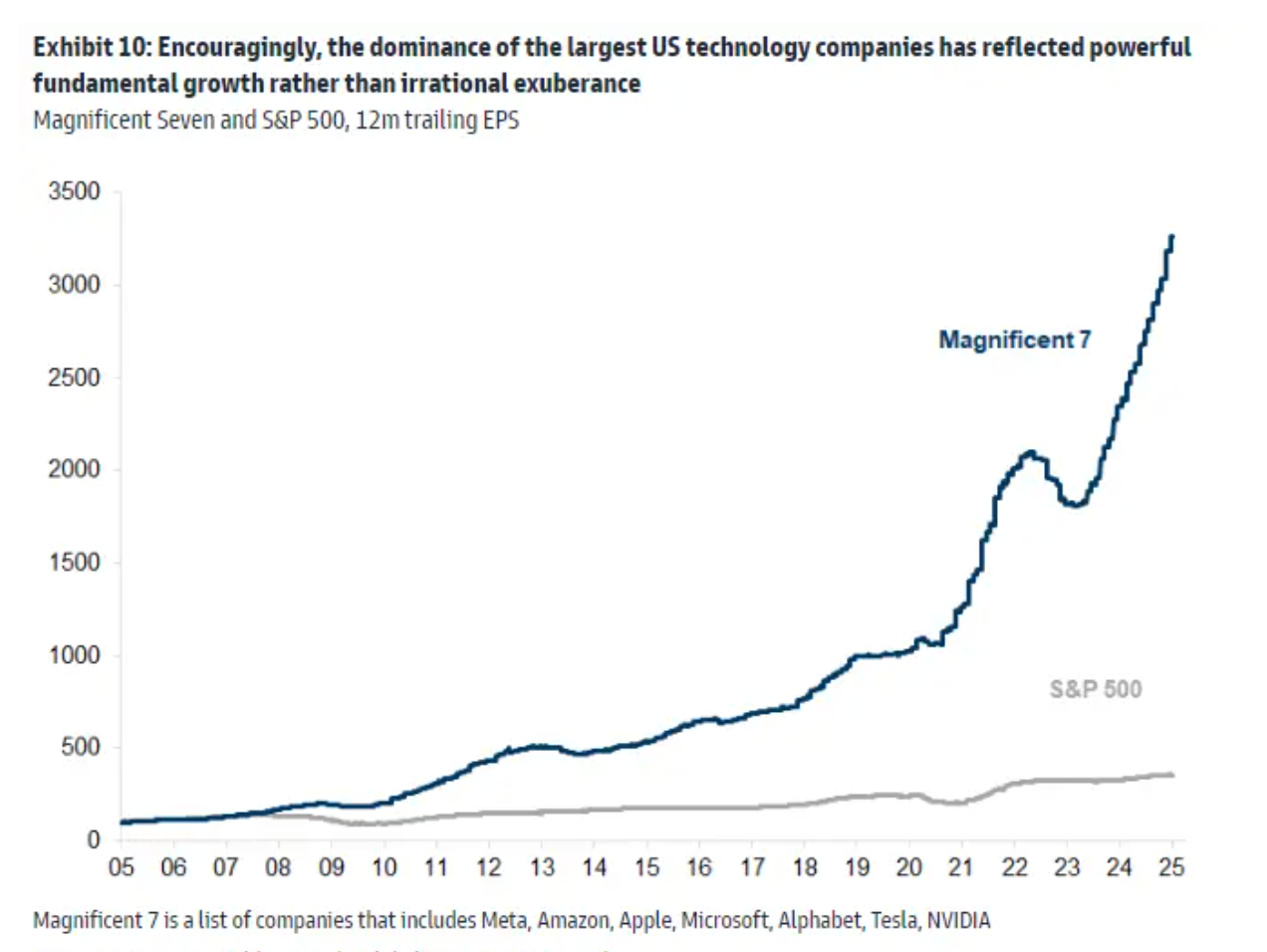

Figure 4 below shows the returns of “Magnificent 7” (Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia, Tesla) and the S&P 500 without these stocks included. This divergence makes clear just how much of the market’s recent strength has been concentrated in a handful of equities. Such dominance creates a high degree of concentration risk.

These tech mega firms are betting big on AI; this year alone big tech has spent $155 billion on AI development. Are we in a bubble? Even Sam Altman would tentatively agree.

If the market begins to doubt the sustainability of these investments, the subsequent correction would cascade into crypto.

We already witnessed a preview of this fragility earlier this year, when reports that Chinese owned DeepSeek had trained its flagship model at a fraction of OpenAI’s costs. This sent shockwaves through the market, with Nvidia dropping 17% in a single day. Highly correlated, the crypto market fared just as badly. This shows just how quickly sentiment can turn when lofty assumptions around AI economics are challenged.

Compounding this, a resurgence in USD strength is another danger for risk-on assets. A stronger dollar tightens global liquidity and drags on equity valuations, potentially accelerating a market correction.

Price Predictions

September has historically been the weakest month for crypto, largely due to the close of the US financial year, but the outlook brightens considerably as we move into October.

For ETH, the most likely best case is a run to $6K by the end of the year, particularly if demand for DATs continues and the Fed keeps cutting rates. A push toward $8K would likely mark the top of the cycle, though that’s more plausible by mid-2026. On the downside, heightened trade wars or tariffs could see ETH retest $3K.

Bitcoin shows a similarly wide range of outcomes. In favorable conditions, BTC could rally to $140K by year-end, with $200K as a conservative cycle top and even $250K possible if institutional flows persist. In a weaker scenario with fewer rate cuts and worsening trade frictions, BTC could retest $90K. Meanwhile, the ETH/BTC ratio (currently at 0.04) could push towards 0.08 - 0.15 if ETH DATs continue at their current rate.