Institutions want exposure to onchain derivatives without changing how they custody assets.

That constraint has shaped most institutional crypto infrastructure to date: assets remain with a regulated custodian, risk committees retain oversight, and trading venues adapt around those requirements. DeFi has historically failed this test, forcing asset movement, wrapping, or bridge exposure to access onchain markets.

In partnership with Strands Finance, we’ve built an off-exchange custody model used in TradFi and centralized crypto markets directly to DeFi. Institutions and large holders can now trade options and perpetuals on Derive while assets remain fully secured in cold storage at the custodian of their choice.

Where did this come from?

Across conversations with funds, desks, and allocators, the feedback has been consistent:

- Institutions want onchain liquidity and capital efficiency

- They do NOT want to move assets, bridge funds, or accept new smart-contract exposure to principal

- They want flexibility across custodians, not venue-locked custody arrangements

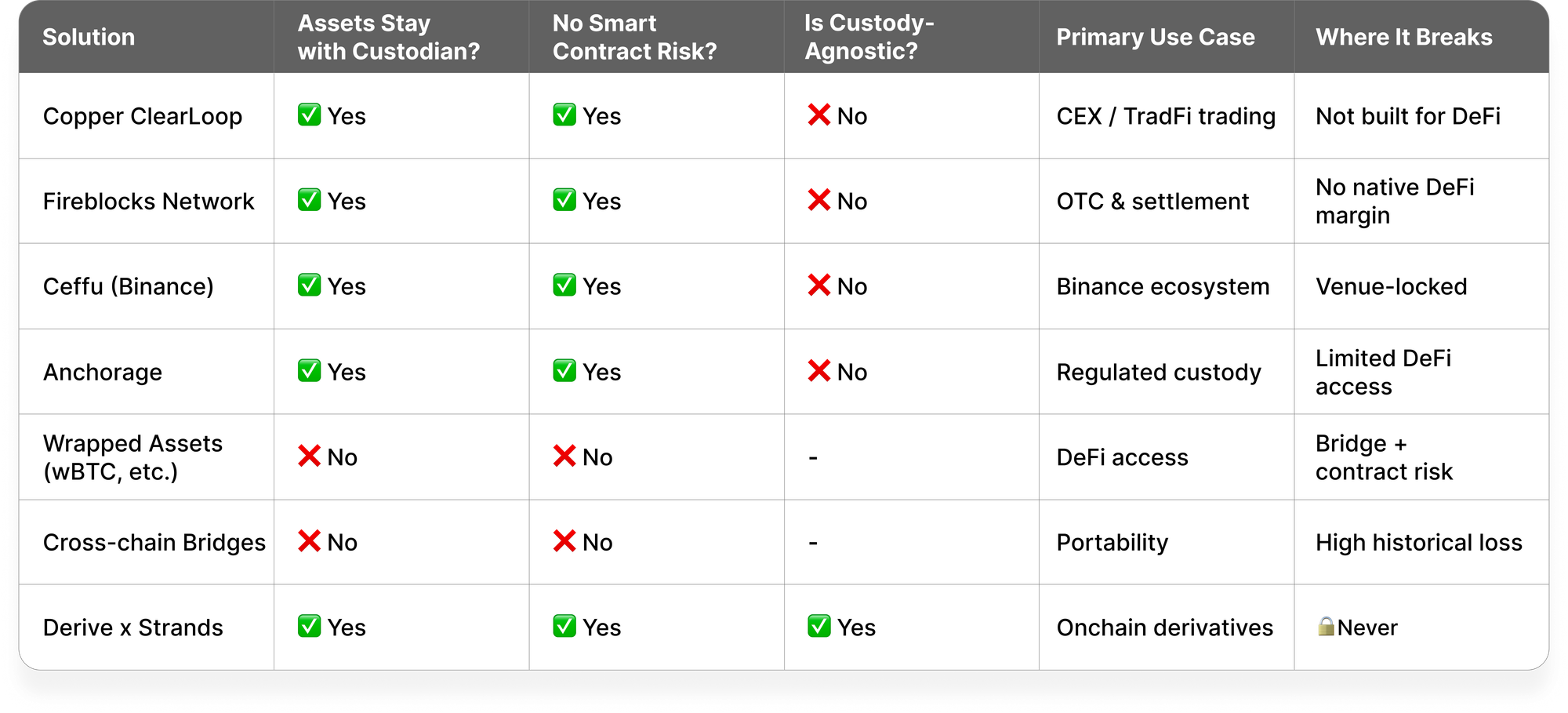

Most existing solutions force a trade-off between access and control. Wrapped assets introduce contract and bridge risk. Exchange-specific custody solutions limit portability. Cross-chain bridges have a long history of loss.

So what did we build?

We built ClearLoop for DeFi. Our custody-agnostic solution allows institutions and large holders to:

- Use native BTC, ETH, and stablecoins held at their custodian as trading collateral

- Keep assets fully in cold storage at all times

- Eliminate bridge and smart-contract risk to principal

- Trade onchain options and perpetuals under familiar custody structures

- Put idle assets to work earning yield via volatility strategies

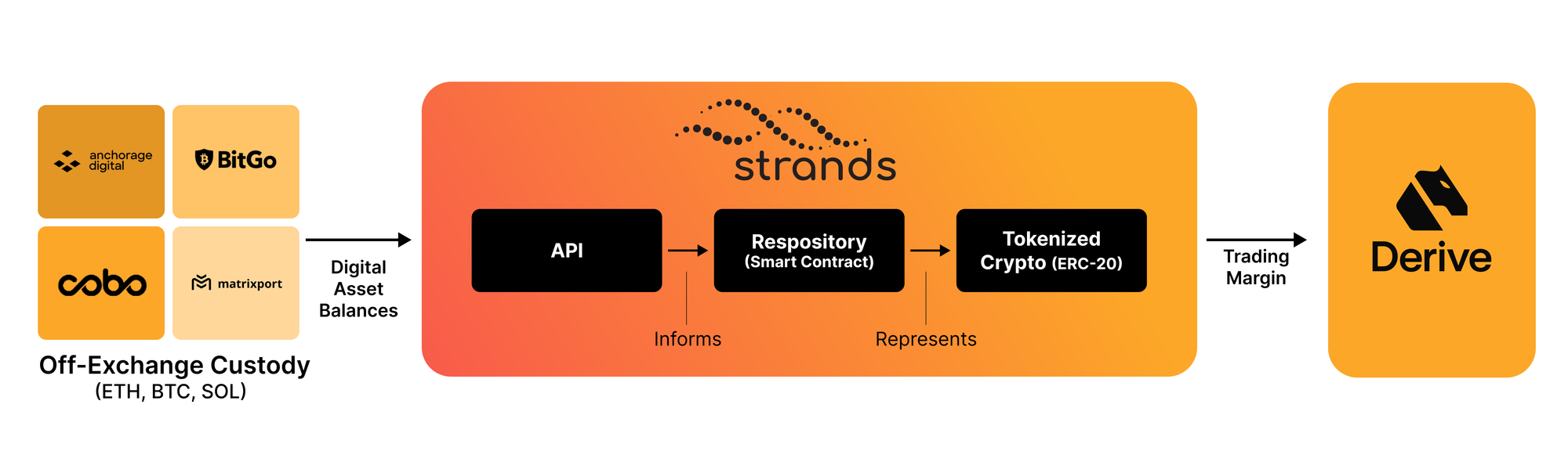

What’s happening under the hood?

- Assets remain at the client’s chosen custodian

- Custodial balances are securely referenced

- A 1:1 onchain tokenized proxy (e.g.

strandsBTC) is issued - The proxy is used as collateral on Derive

- On exit, the proxy is burned assets never move

Because the underlying assets never leave custody, smart-contract risk to principal is removed entirely.

Why would institutions go for this?

This structure aligns with how institutional crypto portfolios are already managed. BTC and ETH stay exactly where risk committees expect them to be with no asset transfers, bridges, or wrapping. Lastly, the solution is custody-agnostic by design and works with leading custodians, including Anchorage, BitGo, Fireblocks, Copper, Zodia, Cobo, and Matrixport.

Strands’ infrastructure has been live on Derive for nearly two years and has already tokenized over $10B in CME positions and $25B in total assets. This integration expands access by enabling:

- Native BTC and ETH as collateral

- Segregated or omnibus account structures

- Multi-custodian support

- A future-proof tokenized margin architecture

How this stacks up in the market

Most institutional custody solutions were built for centralized venues or bilateral settlement. They were not designed for native DeFi margining or onchain derivatives.

In conclusion

Derive and Strands are opening up this pilot program for institutional participants:

- $2–5M initial allocation

- Institutional custody required

- Preferential early-mover terms

- Direct integration support

Interested parties can contact the Derive team at hitesh@derivelabs.xyz to discuss eligibility.