Derive.xyz (formerly Lyra) is the leading onchain options platform and has recently bridged to HyperEVM, supporting Hype collateral and Options.

Hype holders can now use their wHYPE and kHYPE from Kinetiq as collateral and generate yield, hedge or run accumulation strategies using options.

Derive is 5+ years live, with zero security or insolvency incidents. Offering self-custody with CEX-level execution.

Details:

- HYPE stays custodied on Hyperliquid (TVL does not move off-chain).

- Derive recognizes this escrowed wHYPE & kHype as collateral that can be used to trade all perps and options on BTC, ETH & HYPE.

- Effectively, HYPE becomes productive collateral; holders can earn yield without selling or leaving the HL ecosystem.

- Earn yield, don’t dumpRather than selling HYPE, users can write options strategies such as covered calls and earn 7–15% annualized premiums. It’s sustainable yield that benefits both traders and the broader HL ecosystem.

- Utility beyond holdingHYPE holders can now use their tokens as collateral to trade options and perps on Derive; earning yield instead of selling. This turns HYPE into productive collateral.

- Composability with HyperliquidThrough the bridge vault on HyperEVM, TVL stays on Hyperliquid while unlocking new use cases on Derive. This keeps liquidity within the HL ecosystem while extending utility across chains.

- Expanding derivatives accessHYPE options and perps mark the first step toward deeper integration between Hyperliquid and Derive; bringing HL communities into onchain options markets for the first time.

- Win–win ecosystem alignmentDerive gains new collateral and users; HYPE holders gain yield opportunities and new utility. The collaboration aligns both ecosystems around real onchain activity.

Additional details

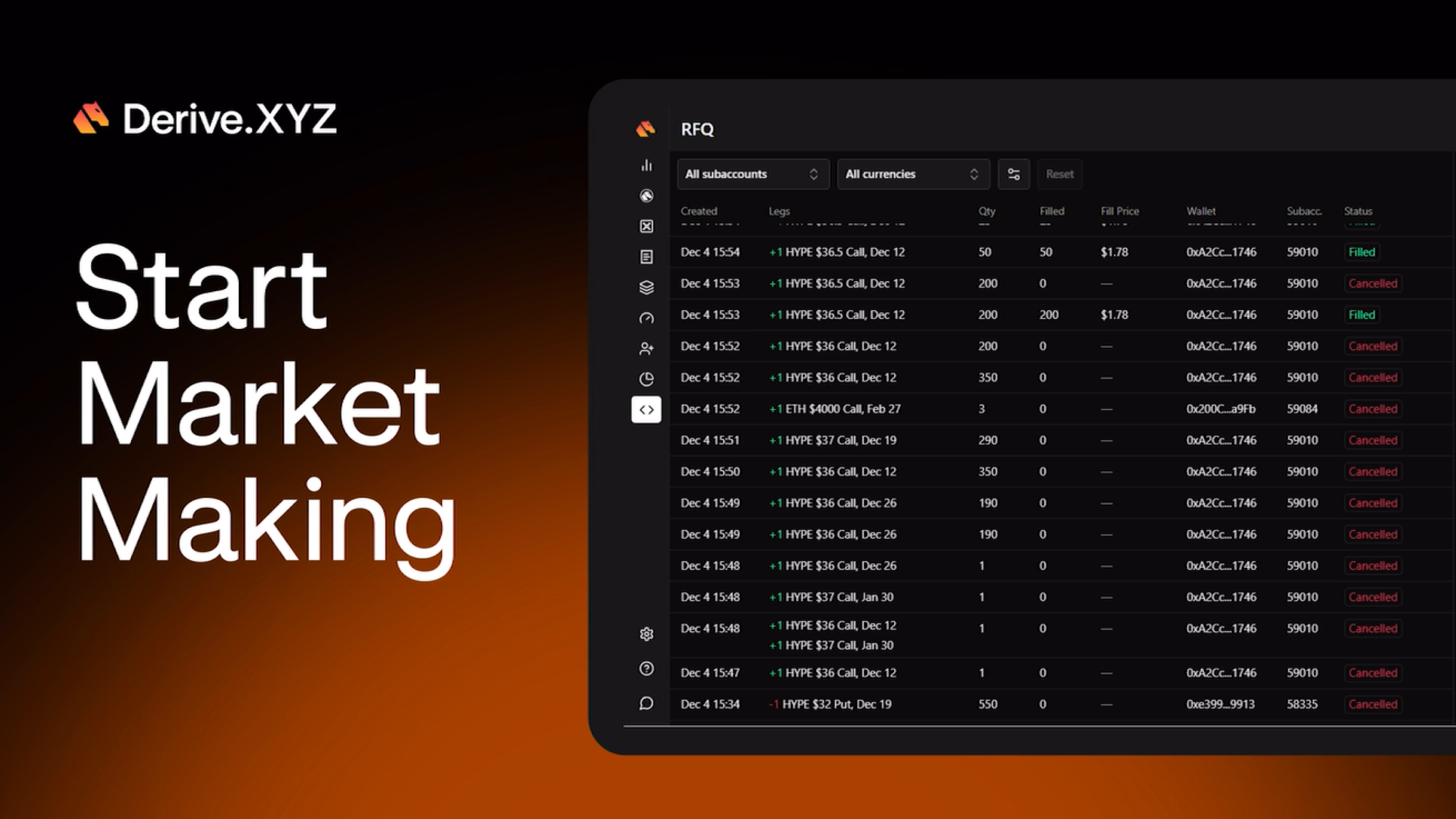

- Hype Options are available through Derive’s RFQ system.

- Anyone is available to make markets on HYPE or BTC and ETH and respond to the RFQ, and compete with pro’s - contact us **https://app.derive.xyz/rfq**

- FalconX is one of the leading MMs providing liquidity on Derive alongside other toptier MMs

Why traders choose Derive:

➤ Institutional-grade execution: Sub-ms latency, 20m TPS

➤ Self-custodial & permissionless: Zero custody risk

➤ Lowest fees: Top-tier maker/taker [-0.5bp / 0.75bp]

➤ Deep liquidity: FalconX + top-tier Market Makers

➤ Block RFQ: Competitive pricing for large size

➤ Portfolio margining: Capital-efficient cross-asset margin

➤ 18+ collateral types: BTC, ETH, Hype, staked assets, yield assets

➤ Regulated MPC custody: Fireblocks, Anchorage, Copper, and ClearLoop-style mirroring

Derive’s full story:

Why Trade on

We are Derive XYZ (formerly Lyra), the largest self-custodial options exchange, often described as “Deribit onchain.”

Derive has processed $18B+ in notional volume, generated over $6M in revenue, and bought back more than 1% of the token supply from said revenues. We currently hold about $500M in open interest, primarily in options, and deliver CEX-level execution with the advantages of self-custody and institutional MPC custody via partners like Fireblocks, Anchorage, Copper and more.

Live for over five years without a security or insolvency incident, Derive is seeing accelerated growth following the Deribit sale to Coinbase; particularly from Asian desks seeking a neutral venue.

Liquidity is top-tier, supported by FalconX and other major market makers. RFQ provides highly competitive pricing for large block trades, while orderbook liquidity continues to deepen.

Derive is also rolling out altcoin options, already supports a broad range of collateral types (+18 collaterals) that CEXs don’t have. Institutions want to harvest volatility consistently through options - Derive is that venue.

Our key advantages

Seamless onboarding

It’s fully self-custodial and permissionless. Onboarding takes less than 5 minutes. Leveraging smart contracts, Derive enables settlement of options contracts between counterparties with no intermediaries, legal agreements, or clearing-houses. You simply need to send such parties a link with the trade, and that flow will route 100% to you.

Low Fees

We provide lower fees than Deribit, and our new institutional fee tiers are 33% better than the main competitors. Specifically, our top tiers for maker/taker on the OB is [-0.5bp, 0.75 bp].

Transparency

Everything is transparent. All margin rules, liquidations, and risk parameters are publicly verifiable; no hidden mechanisms. Unlike centralized exchanges, you are in control of your funds on Derive. As a decentralized exchange, you have full custody and control of your collateral and positions. Derive can never seize or misuse your funds. Additionally, our system handled the 10/10 event exceptionally well, proving the robustness of our risk management.

Premier Custody Solutions

Institutions can engage via regulated custodians (Fireblocks, Anchorage MPC wallet (proto), or controlled WalletConnect access. For large users concerned about depositing tens of millions into a smart contract, we offer ClearLoop-style mirroring to maintain security while enabling onchain exposure. Simply put, the way this works is that these assets can be held on a cold wallet and a feed of this balance (read onchain) will be used to inform a “mirrored” (i.e. tokenized) balance of this asset on Derive.

Consistent Yield through vol selling

With basis trades now yielding less than 1%, funds are moving up the risk curve in search of yield. Options are becoming the go-to product for that purpose. DATs and major holders are already using Derive to generate structured yield through volatility harvesting.

White-glove service

While we don’t expect users to fully migrate immediately, this is the ideal time to diversify; and we’ll do everything possible to make that transition seamless.

Why options, and why now?

Options are traditionally the last market to mature. As crypto becomes increasingly institutional, that time has arrived. Derive dominates the onchain options category much like Deribit dominates CEX options. Most competitors have failed or given up because building deep, liquid, onchain options infrastructure is extremely difficult. This creates a natural moat and a winner takes most market. Meanwhile, large CEXs have been too profitable to focus on something so complex. However, the Deribit sale is changing that landscape, and Derive is positioned to lead as the onchain category scales 100x.|

Product highlights

➤ Top-Tier Security: Fully self-custodial with a 100% on-chain, audited smart contracts & risk engine.

➤ High Throughput, Low Latency: CEX-quality performance for onchain options and perps.

➤ CLOB + RFQ: Trade spot, futures, and options through a fast orderbook and competitive block-trade RFQ system.

➤ Capital Efficiency: Portfolio margining, cross-asset collateral, and flexible settlement far beyond centralized venues.

➤ Onchain Transparency: All margin rules, liquidations, and risk parameters are publicly verifiable; no hidden mechanisms.

➤ Deep Liquidity & Best Execution: Hybrid RFQ/orderbook model ensures tight pricing and large-size fills.

➤ Diverse Strategies: Options, perps, structured products, fixed/floating-rate lending.

➤ Institutional Custody: Fireblocks, Anchorage MPC (Proto), and restricted WalletConnect flows.

➤ Low Fees & Incentives: Class-leading execution costs, rebates, and $DRV/$OP rewards.

➤ Institutional Support: White-glove onboarding, and custom custody integrations.