Start here. See what makes Derive different and get familiar with the layout and tools that power your trading.

If you’ve never traded options before, the interface can feel overwhelming.

If you’ve used Derive before, you may not have seen just how deep and flexible the platform is.

Today, we walk through the core layout of Derive and explain the most important parts of your trading screen.

Don’t worry if you don’t know these terms or understand what the interface is showing yet, we’ll get to that!

Key Components of the Derive UI

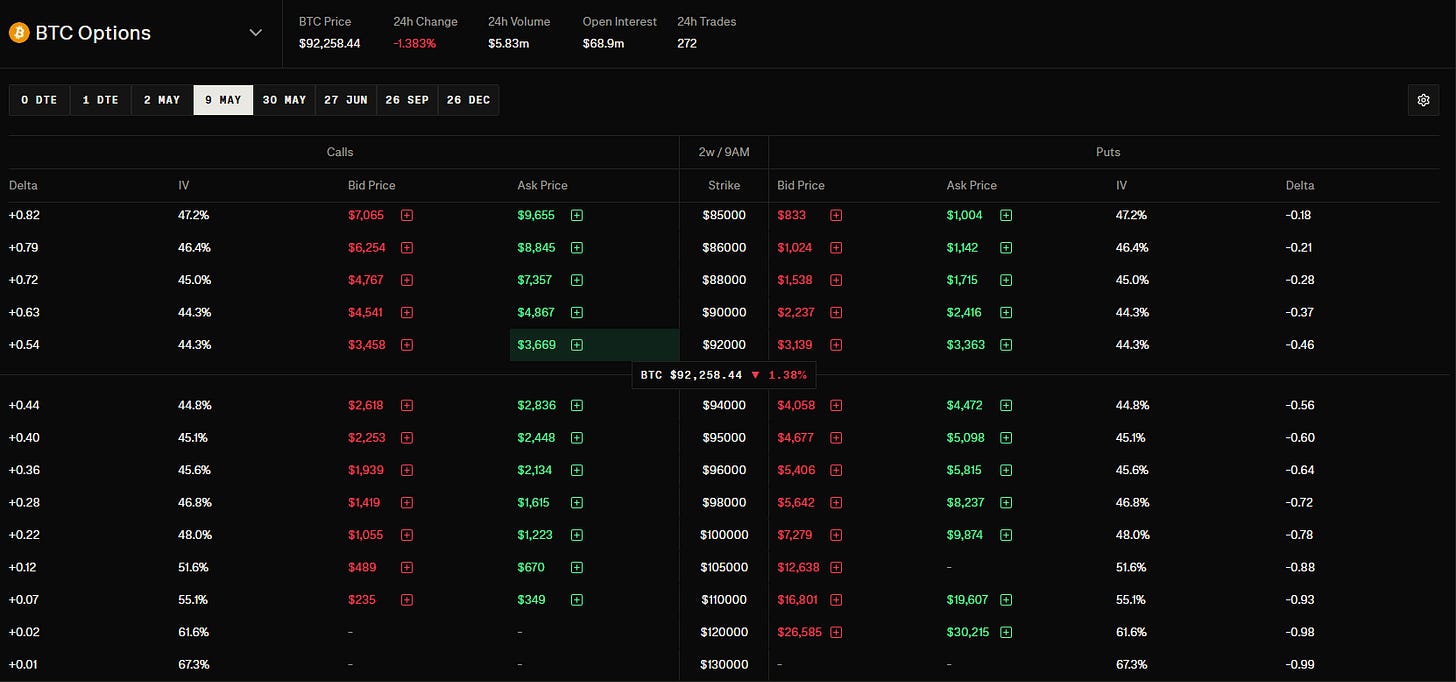

1. Options Chain

This is where you browse calls and puts for a given asset. You’ll see:

- Strike prices

- Expiry dates

- Premiums

- Greeks (Delta, Gamma, Theta, Vega)

Derive's BTC options chain shows strike prices, premiums, implied volatilities, and live Greeks, all on-chain.

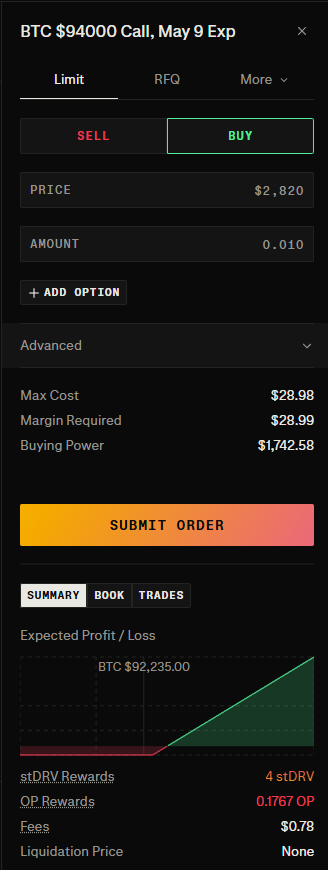

2. Trade Ticket

Once you select an option, the trade ticket opens, here you will:

- Set quantity and price

- Choose limit or market order

- See margin required and your total exposure

- Visualize your payoff curve before submitting

Derive’s trade ticket shows your order size, cost, margin required, and real-time payoff before you hit submit.

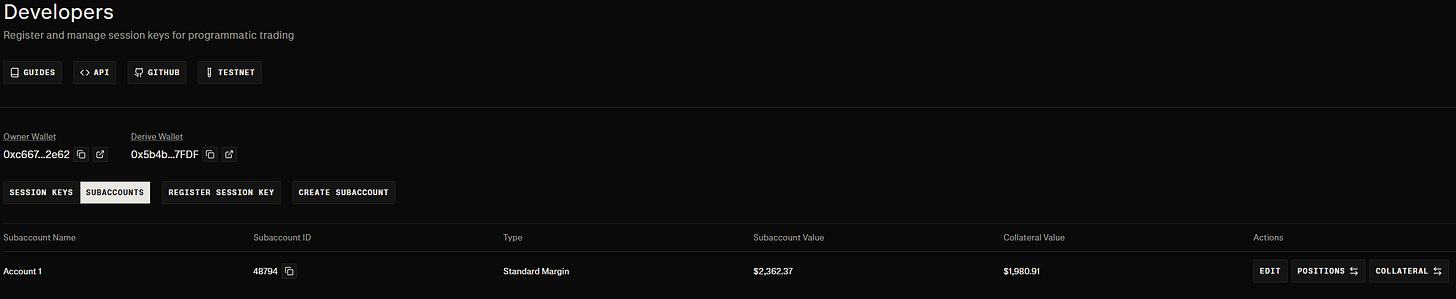

3. Subaccounts

Each Derive subaccount is a crypto-native NFT that acts as an isolated trading environment. Use multiple accounts to separate strategies or control risk.

Each subaccount has its own ID, margin settings, and value, making it easy to test, trade, or manage risk independently.

4. Portfolio View

Your entire account view in one place — positions, margin, balances, PnL, and more.

Monitor your open positions, unrealized PnL, realized PnL, and portfolio value in real time.

5. Greeks Dashboard

The Greeks tab provides real-time Delta, Vega, Gamma, and Theta, essential tools for advanced options risk management.

Derive gives you portfolio-level Greeks at a glance so you can manage risk like a professional.

Why This Matters

You can’t trade well if you don’t understand your tools.

Derive puts professional-grade functionality in the hands of every trader with clarity, precision, and flexibility.

This is what on-chain options infrastructure should look like.

Your Action Today

- Visit derive.xyz

- Browse BTC or ETH options

- Click into the trade ticket

- Explore subaccounts, Greeks, and positions

You don’t need to place a trade. Just get comfortable with the layout.

If you dive in but have questions, you can always ask our helpful community or open a support ticket on our discord (be wary of scammers offering bogus support as always!)

https://discord.gg/CMEXcVQw7x

Coming tomorrow:

Day 3 – European vs American Options: What Derive Gets Right

Hasta manana

Cpt