Time is not neutral in options trading. It works against buyers and for sellers.

Every day that passes affects the value of an option, even if the price of the underlying asset does not move.

This effect is called time decay, and it is one of the most important forces in options trading.

Today we explain what time decay is, how Theta measures it, and how it shapes your trading strategy.

What Is Time Decay

Options are wasting assets.

They are valuable because they represent a right to buy or sell in the future, but as time passes, that future shrinks.

If nothing happens in the underlying asset, the option loses value simply because there is less time left for something to happen.

Time decay eats away at the premium of an option every day.

This happens fastest as expiry approaches.

What Is Theta

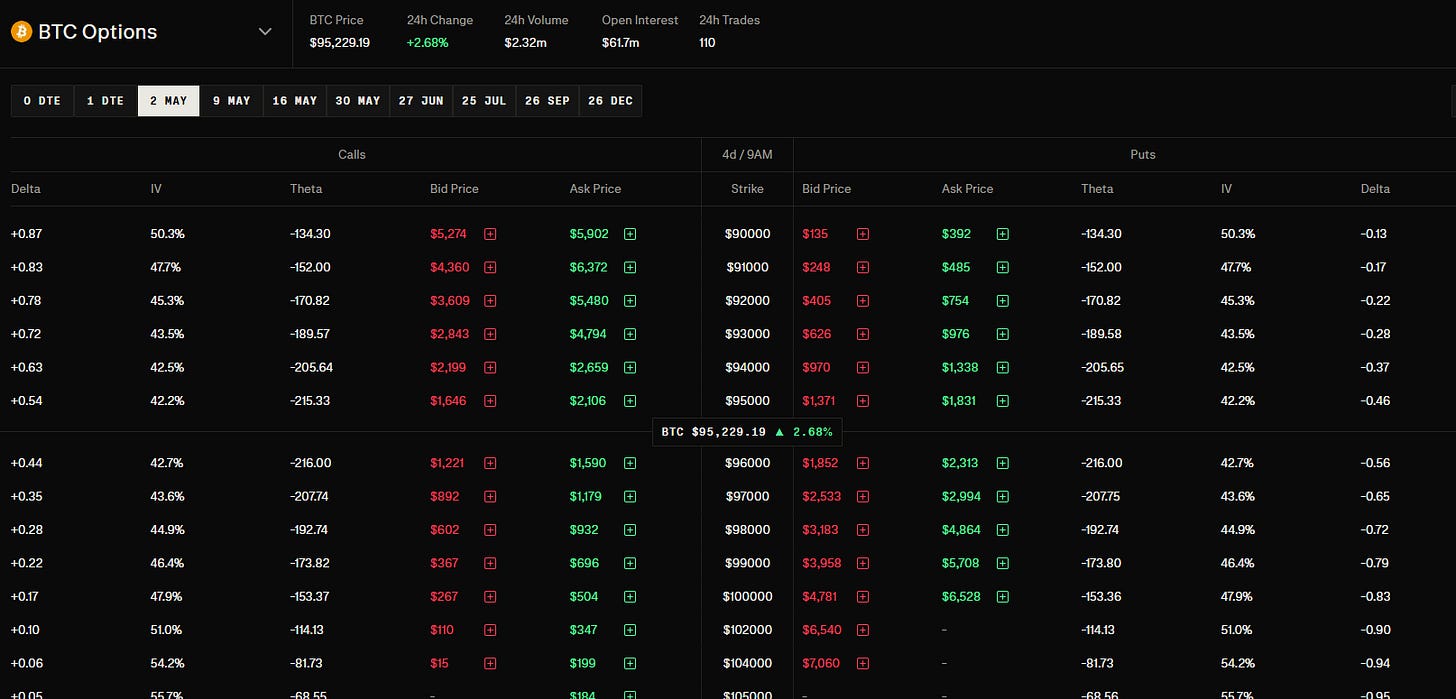

Theta measures how much an option’s price will decrease per day, all else being equal.

- If an option has a Theta of -5, it means you can expect it to lose 5 units of value per day just from the passage of time

- Buyers of options are hurt by Theta

- Sellers of options benefit from Theta

Theta increases as expiry gets closer.

The closer you are to the expiry date, the faster time decay accelerates.

Visualizing Time Decay

Imagine holding a call option that expires in two months.

At first, time decay is slow and steady.

But in the final weeks, the premium starts to decay rapidly, especially if the option is out-of-the-money.

On Derive, you can see Theta listed in the options chain (click the setting wheel top right to edit), giving you transparency into how time affects your positions.

Why This Matters

Understanding Theta changes how you think about holding options.

- If you are buying options, you are fighting against time

- If you are selling options, you are collecting the premium that erodes over time

Options trading is not just about direction. It is about price, volatility, and time.

Your Action Today

- Open the Derive options chain for BTC or ETH

- Look at the Theta value for near-term options and longer-term options

- Notice how Theta increases as options get closer to expiry

- Think about how time decay would impact a simple long call or long put

Tomorrow we will go deeper into volatility and how it shapes premiums beyond time decay.

Coming tomorrow:

Day 7 – Volatility and Vega: Why Movement Matters

Hasta manana

Cpt