Options are not just bets on direction. They are bets on volatility.

When people first learn about options, they focus on price direction.

- Calls if you think price will rise

- Puts if you think price will fall

- Today we explain what volatility means, how it affects options prices, and how Vega measures it.

What Is Volatility

Volatility measures how much the price of an asset moves, not the direction of the movement.

- High volatility means big swings up and down

- Low volatility means small, steady price changes

An asset with high volatility gives more opportunities for an option to end up profitable.

This is why higher volatility increases options premiums.

More movement equals more potential value for the buyer.

What Is Vega

Vega measures how sensitive an option’s premium is to changes in volatility.

- A high Vega means the option’s price will increase more if implied volatility rises

- A low Vega means the option’s price will not change much if volatility moves

Vega is typically higher for longer-dated options and options at-the-money.

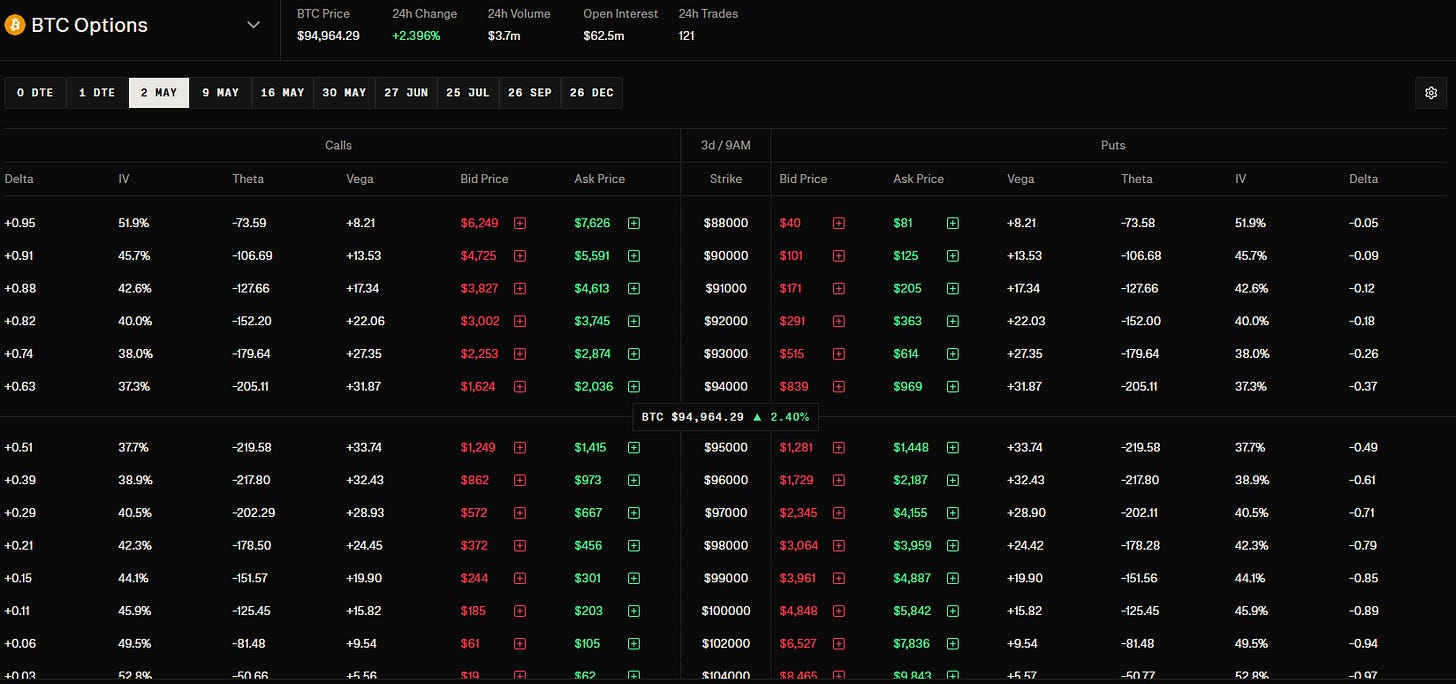

On Derive, you can see Vega displayed next to each option, showing you how volatility impacts the premium.

Why Volatility Matters

When you trade options, you are not just betting on where the price will go.

You are betting on how much it will move, and how quickly.

- If volatility rises after you buy an option, its premium can increase even without price movement

- If volatility falls, the premium can decrease even if price moves slightly in your favor

Understanding volatility helps you choose better trades and manage risk more effectively.

Why This Matters on Derive

Derive offers transparent, on-chain options pricing with real-time Greeks, including Vega.

You can monitor how volatility and time decay are working for or against you without guessing.

This is one of the biggest advantages of trading options on Derive: full visibility into what moves your positions.

Your Action Today

- Open Derive’s options chain for BTC or ETH

- Look at the Vega value for different expiries and strikes

- Notice how Vega changes between near-term and longer-term options

- Think about how a volatility spike or crash would affect the value of your trades

Tomorrow we will tie together price, time, and volatility into a full view of how options really behave.

Coming tomorrow:

Day 8 – Putting It Together: How Price, Time, and Volatility Shape Your Trade

Hasta manana,

Cpt