October 13, 2025 by Nick Forster

We witnessed an unprecedented market meltdown on Friday, with over $19 billion in liquidations across the crypto industry.

Driven by panic and thin liquidity, BTC, ETH and SOL saw flash crashes of -12%, -20% and -24.6% respectively, before stabilising. Altcoins were hit even harder as HYPE (-54%), DOGE (-62%), and AVAX (-70%) all suffered catastrophic drawdowns before recovering to more modest losses.

The crash was triggered by renewed fears of a U.S.-China trade war, after Donald Trump threatened an additional 100% tariff on Chinese imports. This came on the heels of China announcing new restrictions on rare earth element exports, escalating tensions between the two economies.

Trump’s tariff remarks immediately sent shockwaves through global markets. Liquidity evaporated across crypto futures as market makers pulled quotes to avoid breaching risk limits. With order books thinned out, forced liquidations and panic selling had an outsized impact on price, fueling a self-reinforcing cascade of liquidations and accelerating the flash crash.

Volatility Surges Across the Board

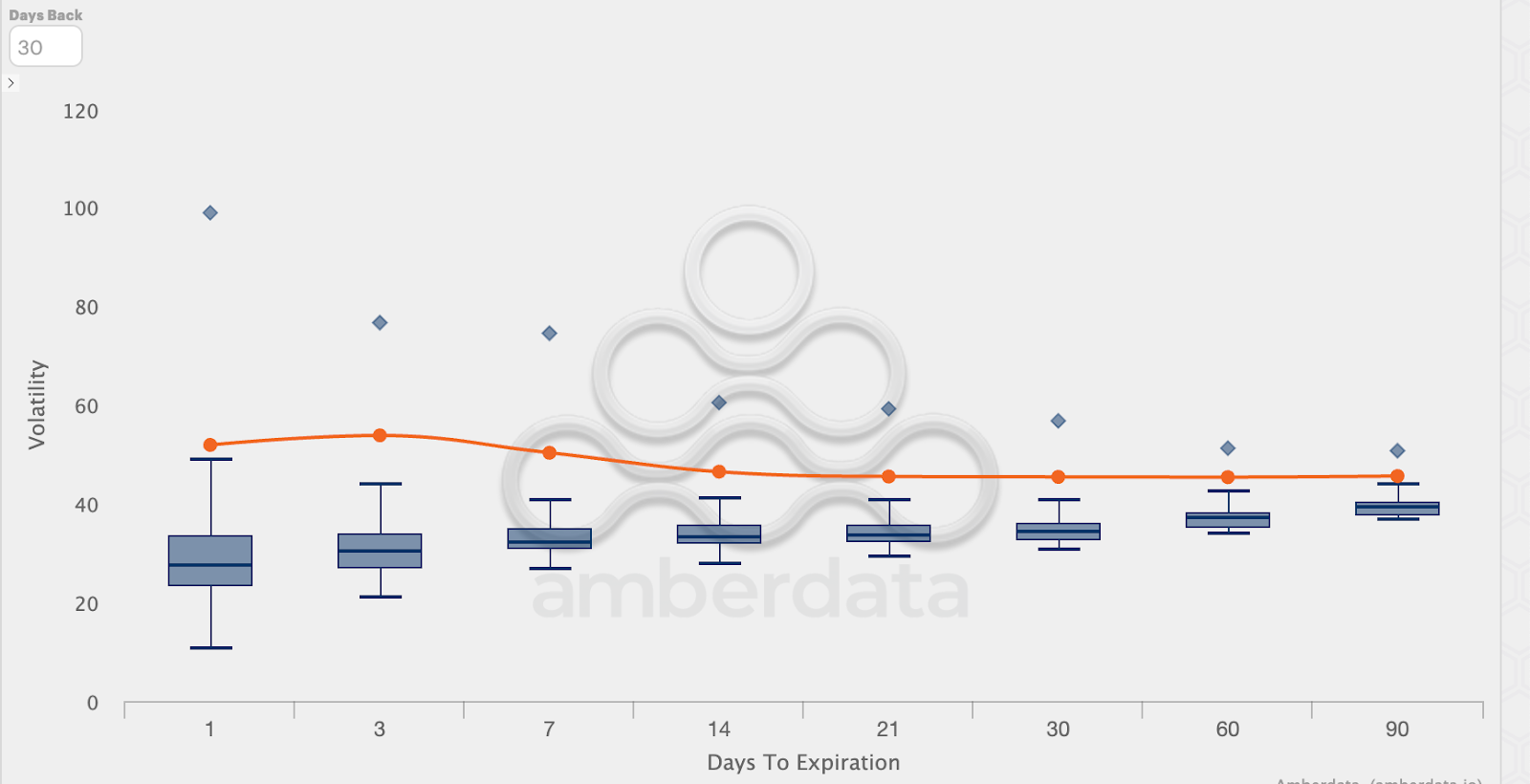

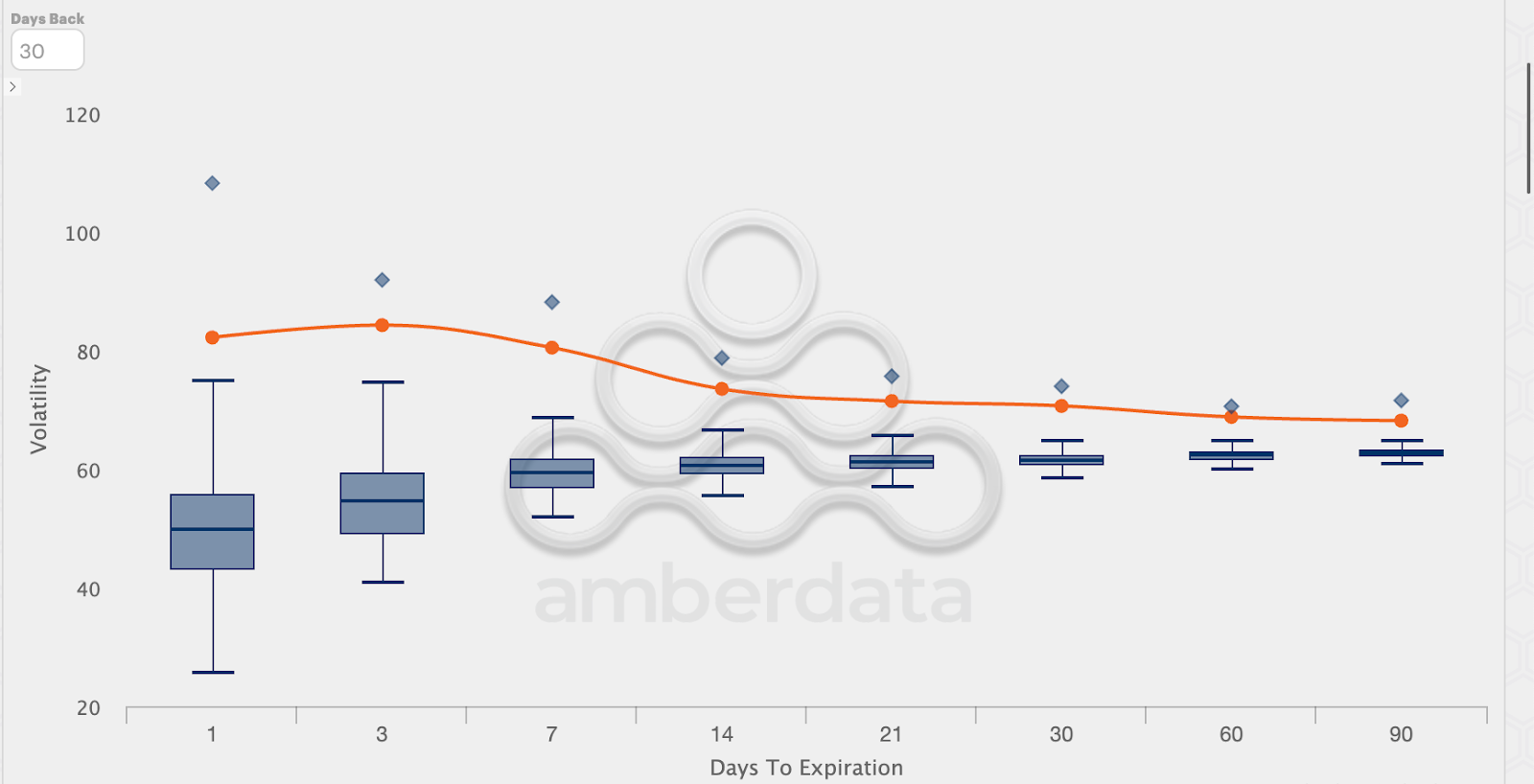

Volatility spiked sharply across BTC and ETH markets. Typically, sharp selloffs only lift short-dated volatility (1-7 DTE) as traders expect near-term turbulence to subside. However, Friday’s downturn drove elevated volatility across all expiries, signaling expectations of sustained turbulence and a choppy road ahead.

BTC IV term structure with box plots overlaid.

ETH IV term structure with box plots overlaid

Options Markets: Skew Collapses, Puts Dominate

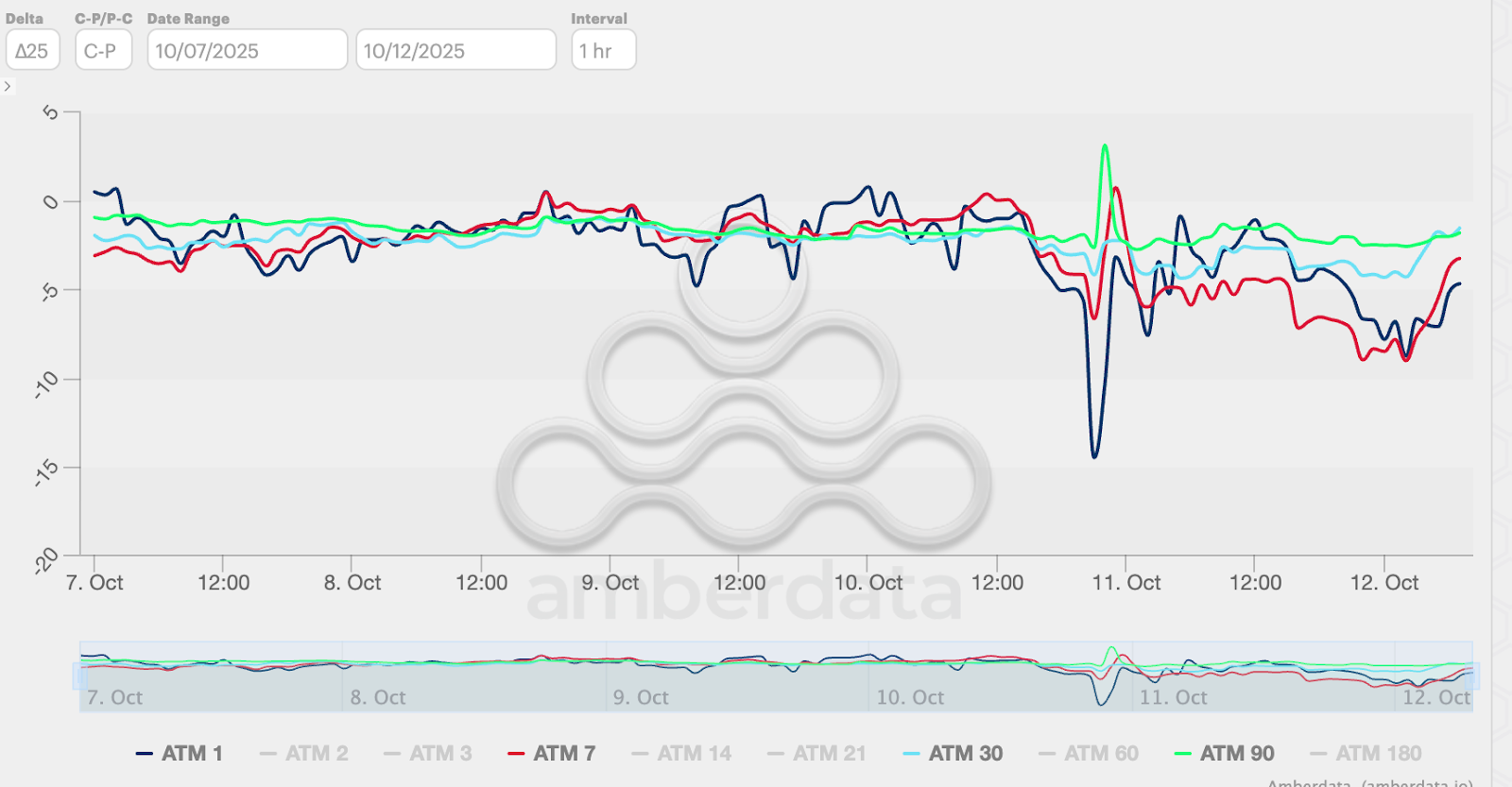

On the day of the crash, options skew dropped sharply for both BTC and ETH, reflecting a rush into downside protection. Skew measures the relative demand for calls versus puts; a more negative value indicates higher demand for puts.

In short-dated expiries (1–14 DTE), skew plummeted (red, blue in the graph below) as traders scrambled to buy puts for insurance. Interestingly, longer-dated skew (90 DTE, green) rose slightly, suggesting cross-expiry hedging activity from volatility desks.

BTC skew over the last week

Flow Highlights: Traders Rotate to Downside Protection

In BTC options, we saw heavy buying of $115K and $95K puts for the October 31 expiry, alongside a sharp reversal from call buying to call selling at the $125K strike (October 17 expiry), signaling a bearish near-term outlook.

For ETH, traders focused on the October 31 $4K and October 17 $3.6K strikes, while substantial buying of $2.6K puts for December 26 expiry reflected growing bearish sentiment through year-end.