November 28, 2025 By Dr. Sean Dawson

Markets are balancing on a knife’s edge, but sentiment has stabilised meaningfully as expectations of a rate cut continue to recover. The probability of a 25 basis point cut at the upcoming FOMC meeting collapsed to 39% just a week ago, yet has since surged back to nearly 87%. In response, BTC has staged a strong rebound, rallying more than 10% from $82K to $91.5K at the time of writing.

This shift in macro expectations has eased some of the intense bearish pressure that dominated the options market through late October and November. The 25-delta skew, a key measure of relative demand for puts versus calls, has moved sharply off its lows:

- 30-day skew: from -7% to -5%

- 7-day skew: from -10% to -4%

Traders are still paying a premium for downside protection, but noticeably less than last week, reflecting reduced fear and a partial unwind of defensive hedging as rate-cut odds firm.

https://x.com/SeanNotShorn/status/1994166332208894011?s=20

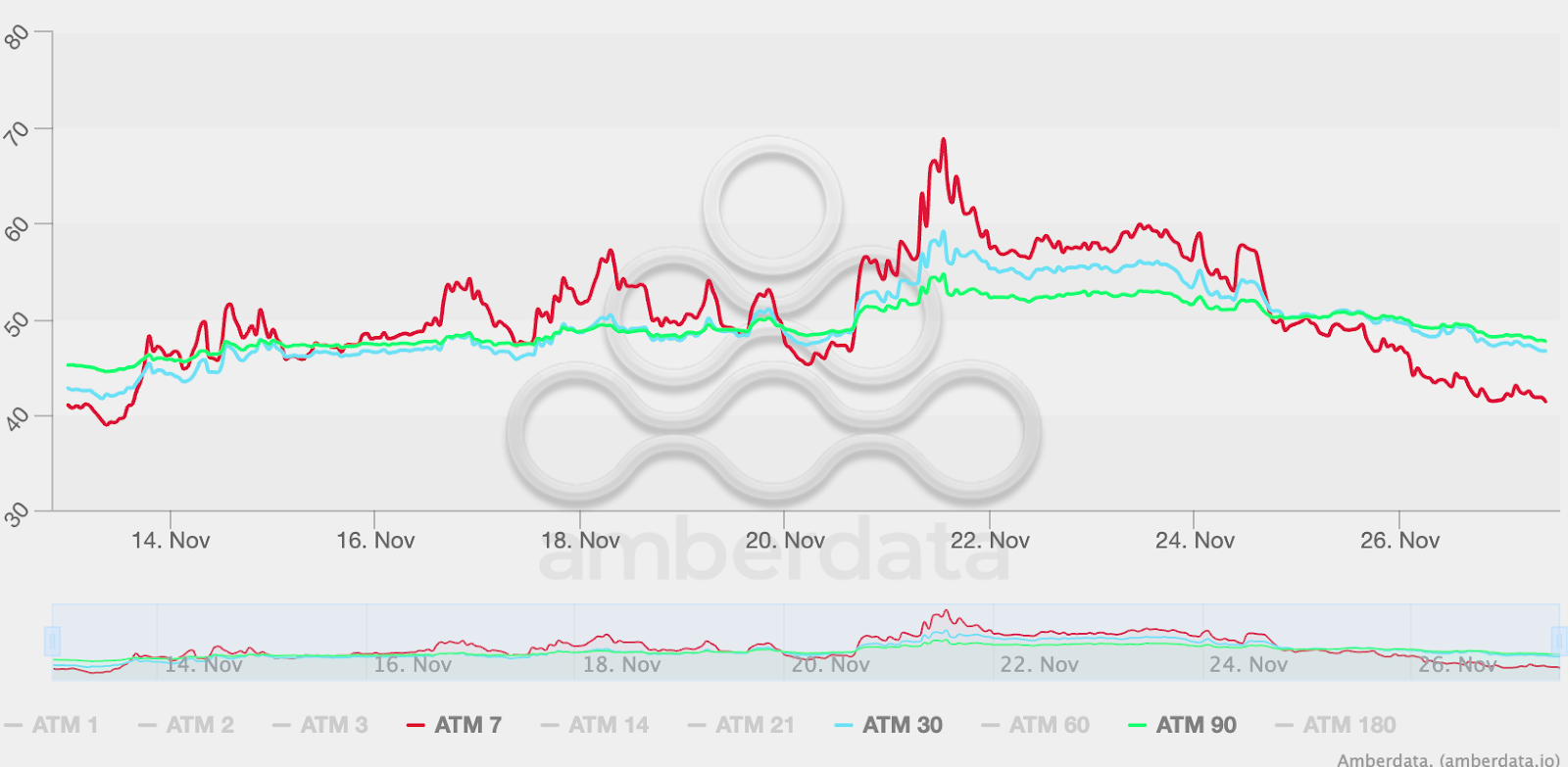

Volatility is cooling as well. The aggressive selloff through October and November drove short-tenor BTC ATM volatility as high as ~60% on November 21. Since then, volatility has compressed almost 25%, now sitting near 45%. This indicates that markets are pricing a lower probability of near-term disorder as liquidity improves and panic flows subside.

BTC ATM volatility

Source: Derive.xyz, Amberdata

Derivatives flow data reinforces this shift. On Derive.xyz over the past 24 hours:

- 41.2% of BTC contracts were puts sold

- 26.5% were calls bought

- Only 23.1% were puts bought

- The remaining 9.2% were calls sold

This positioning – dominated by short puts and long calls – signals a meaningful uptick in trader confidence, with market participants leaning into a rebound rather than hedging against further downside.