December 2, 2025 By Nick Forster

Markets plunged overnight as global liquidity tightened and confidence in crypto deteriorated further following the Yearn hack.

A signal from the Bank of Japan that it may raise rates sent a shockwave through global risk assets, raising fears that liquidity is set to dry up. Traditional markets held up relatively well – for example, the S&P 500 slipped just 0.5% – but crypto absorbed the hit in full force.

BTC dropped 4.7% to $86.5K and ETH fell 7.2% to $2,800, as nearly $1 billion in liquidations swept the market over the past 24 hours. Almost $400 million in BTC was wiped out, while $240 million in ETH perps was liquidated.

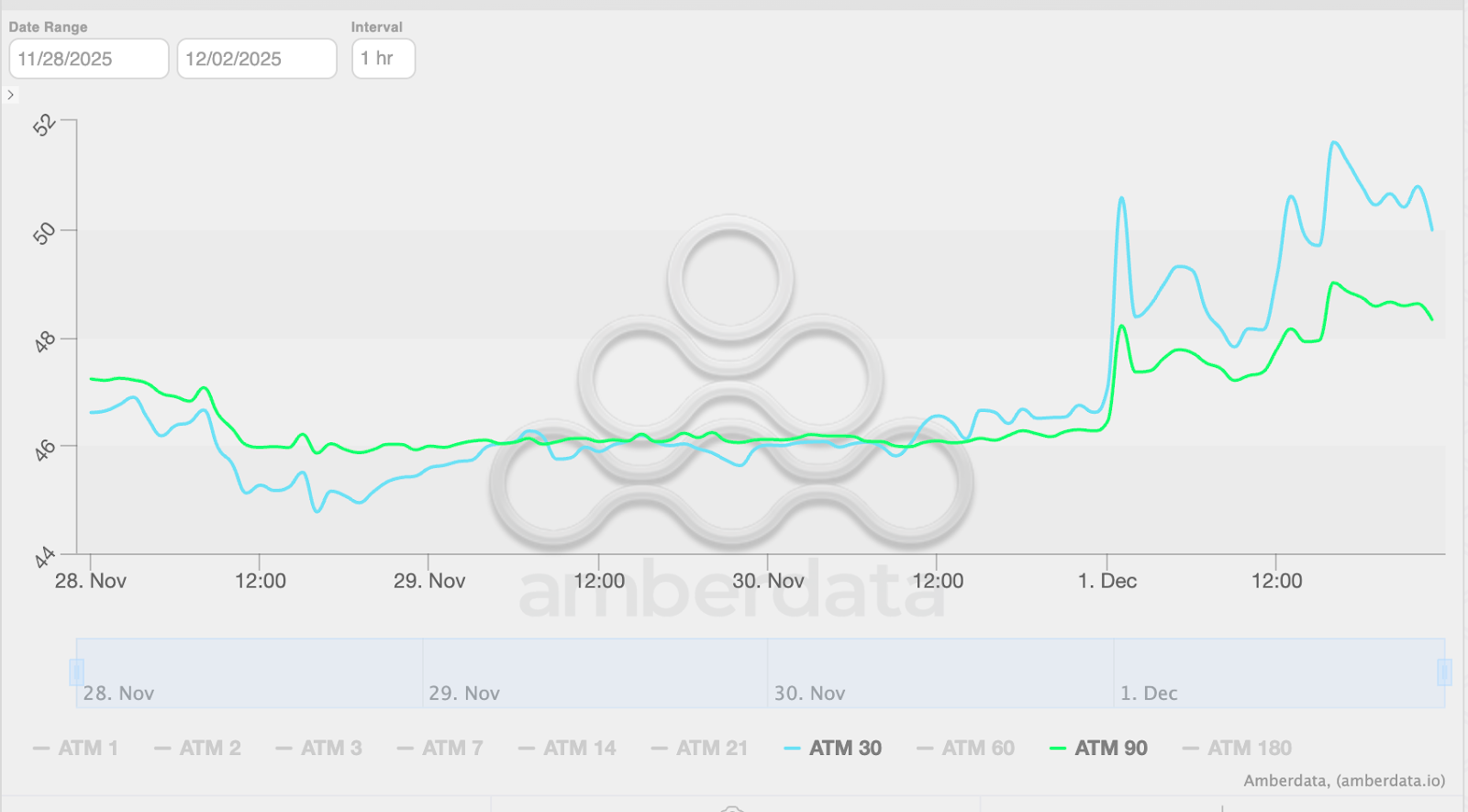

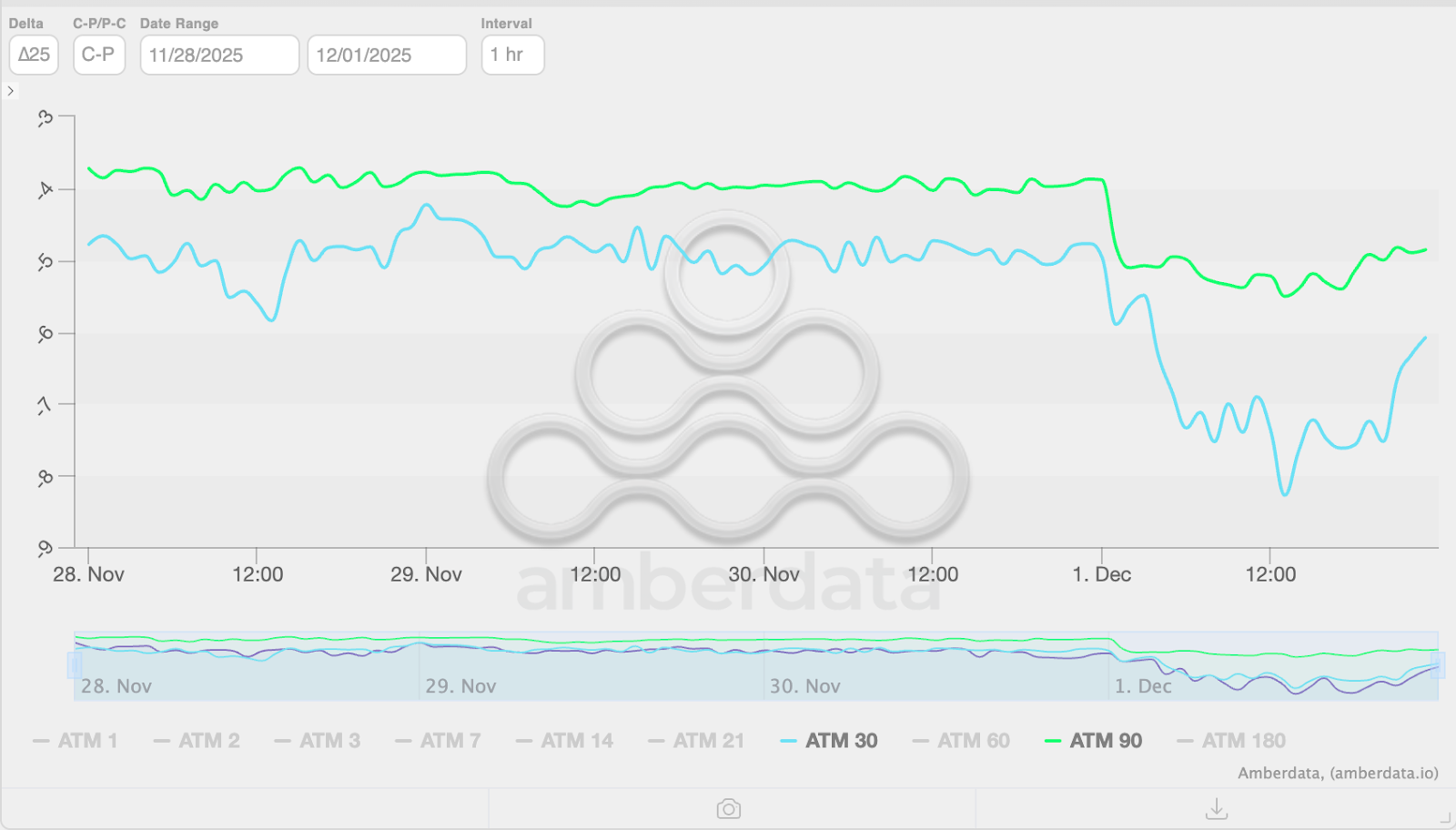

Volatility surged in response. BTC 30-day volatility jumped from 46% to 50% in the past 24 hours, while skew collapsed from -5% to -8% before recovering slightly to -6% at the time of writing. The move reflects aggressive demand for downside protection as traders reposition for further weakness.

BTC ATM volatility

Source: Derive.xyz, Amberdata

BTC Skew

Source: Derive.xyz, Amberdata

I don’t believe the bottom is in. Short-dated volatility now sits above long-dated BTC volatility, signalling that the market expects outsized swings as we head into the new year.

Skew’s sharp step lower shows traders stacking puts, especially into the December 26 expiry, where open interest has concentrated at the $84K and $80K strikes. That positioning implies a meaningful probability of sub-$80K BTC to start 2026.

Macro uncertainty continues to dominate. A BOJ tightening, ambiguity around a U.S. Fed cut, and softening demand from DATs like STRAT all weigh on sentiment.

Interestingly, option markets are slightly more bullish with the increase in volatility:

- 15% chance BTC will be under $80K by year-end – down from 20%

- 21% chance BTC will be above $100K by year-end – up from 17%

- 16% chance ETH will be under $2.5K by year-end – down from 23%

- 23% chance ETH will be above $3.5K by year-end – up from 18%

The market is bracing for volatility, but pricing in slightly less catastrophic downside compared to last week.