January 20, 2026 By Dr. Sean Dawson

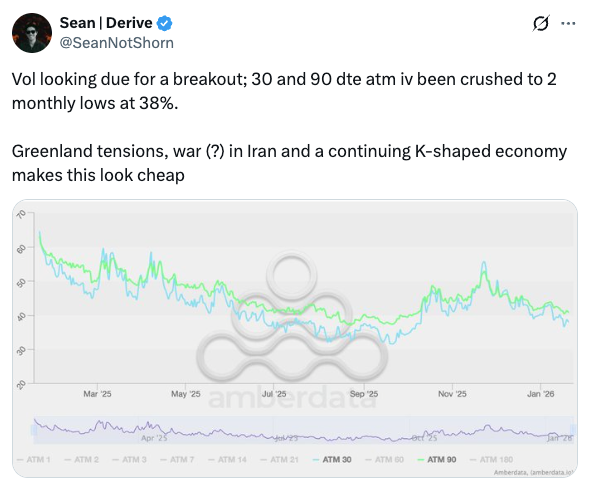

Volatility is coiling for a potential breakout. Markets are unusually calm right now, but that calm is unlikely to last.

BTC volatility has declined steadily to around 38%, a two-month low and well below the 54% levels seen in November. ETH has followed a similar path, with volatility compressing from 78% to 53% over the same period.

https://x.com/SeanNotShorn/status/2013445732397707285?s=20

While markets appear calm on the surface, macro risks are building. Rising geopolitical tensions between the U.S. and Europe – particularly around Greenland – raise the risk of a regime shift back into a higher-volatility environment, a dynamic not currently reflected in spot prices.

From an options perspective, the outlook remains mildly bearish through mid-year. BTC 25-delta skew has deteriorated sharply, falling from +5% this time last year to -3% today, signalling that traders are paying a premium for downside protection.

This persistent skew suggests markets are increasingly positioned for weakness in the first half of the year.

That view is reinforced by positioning. For the BTC June 26 expiry, there is a significant concentration of put open interest across the $75K-$85K strikes, implying expectations of a drawdown into the mid-70s to low-80s before the second half of the year.

Options markets show a clear downside skew, with a 30% chance BTC falls below $80K by June 26, compared to a 19% chance it rallies above $120K over the same period.

These expectations are consistent with trends established since October 10’s flash crash. While markets have stabilised modestly since then, BTC’s rebound above $90K has been tepid, and confidence remains fragile.

Against a backdrop of persistent geopolitical uncertainty, crypto markets appear more risk-averse than in previous cycles, despite historically low realised volatility.