November 19, 2025 By Dr. Sean Dawson

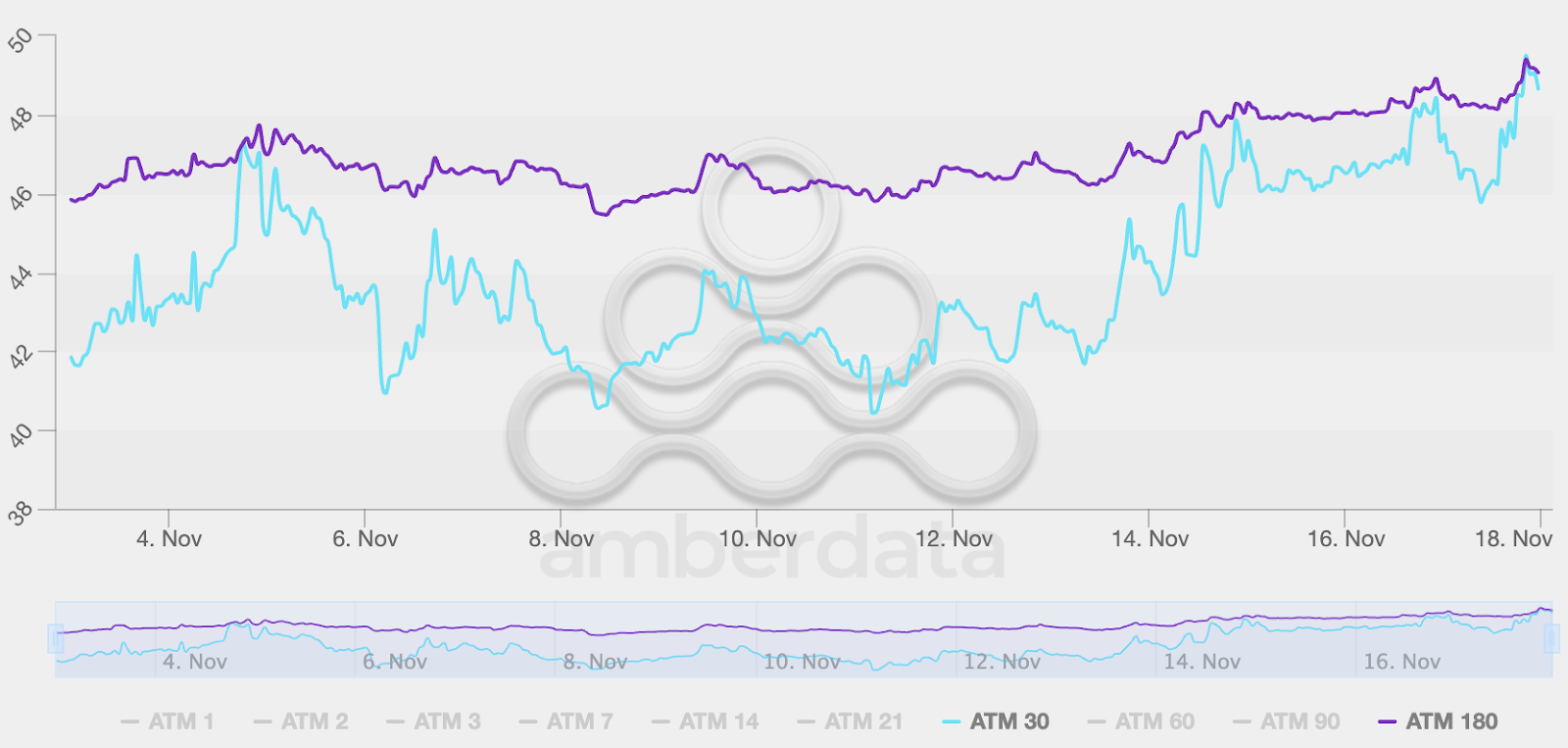

We’re seeing volatility surge across the board. Short-term volatility (30-day tenor) has jumped from 41% to 49% in just two weeks, and long-term volatility (180-day) has moved almost in lockstep, rising from 46% to 49%.

BTC ATM volatility over the last 2 weeks

Source: Derive.xyz, Amberdata

That sharp lift in the long end is particularly telling. It signals that we’re entering a new volatility regime as fears of an equity pullback and a more hawkish Fed begin to spill over into crypto.

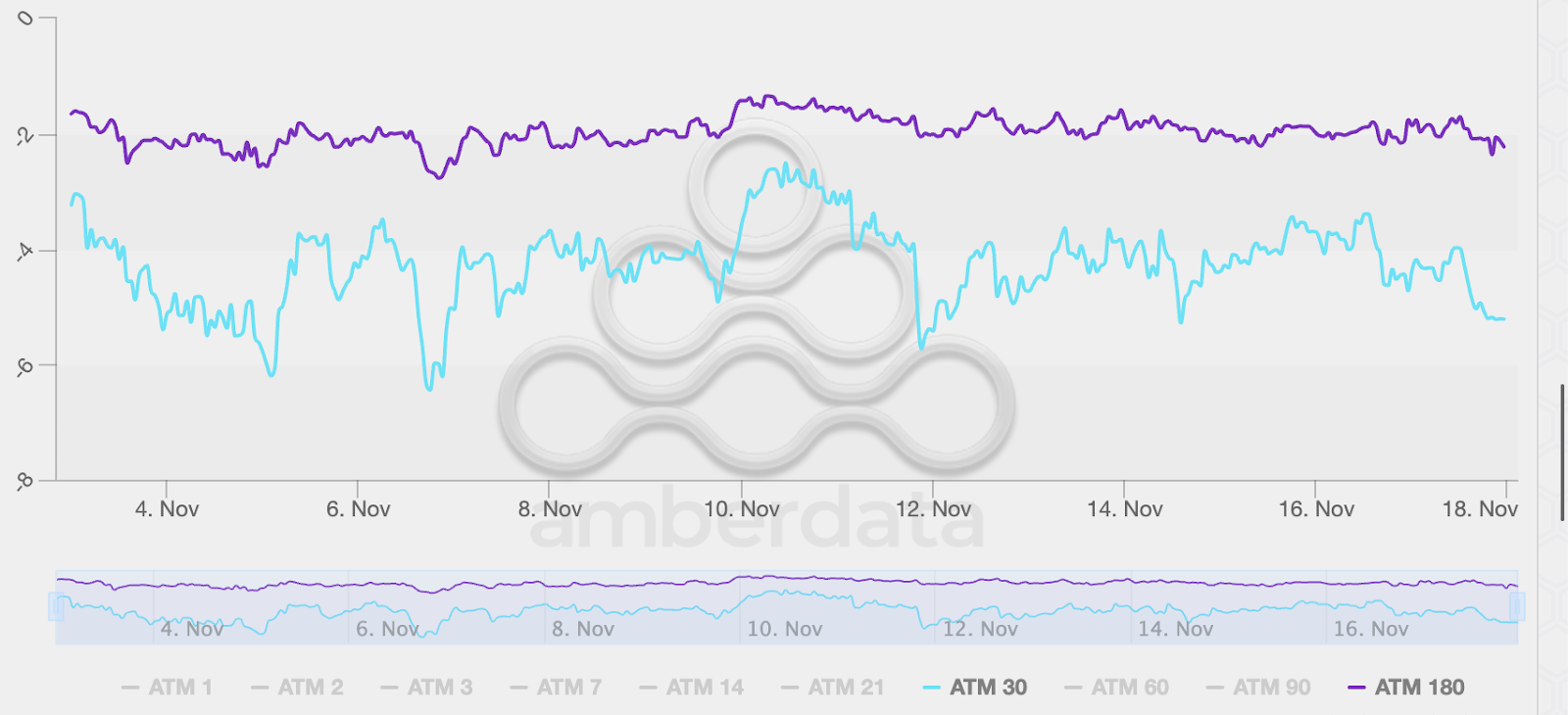

BTC skew has also taken a meaningful hit. Skew is one of the clearest measures of sentiment because it captures the relative pricing of puts versus calls – downside protection versus upside leverage. The 30-day put skew has fallen from -2.9% to -5.3%, which tells us traders are increasingly paying up for downside insurance as prices continue to soften.

BTC 25 delta put skew for short and long dated expiries

Source: Derive.xyz, Amberdata

Looking ahead to year-end, there’s now a sizeable concentration of BTC puts building around the December 26 expiry, particularly at the $80K strike. With ongoing concerns about the resilience of the US job market and the probability of a December rate cut slipping to barely above a coin-toss, there’s very little in the macro backdrop giving traders a reason to stay bullish into the close of the year.

BTC pricing continues to lean bearish. Options markets are assigning only a 30% probability that BTC finishes 2025 above $100K, while there’s now a 50% chance we close the year below $90K.

ETH markets are showing a similarly defensive posture. Traders are pricing a 50% chance ETH slips below $2.9K by year-end, with only a 15% probability of a move above $4K. The distribution reflects growing concern that macro headwinds and elevated volatility will cap any meaningful upside in the near term.