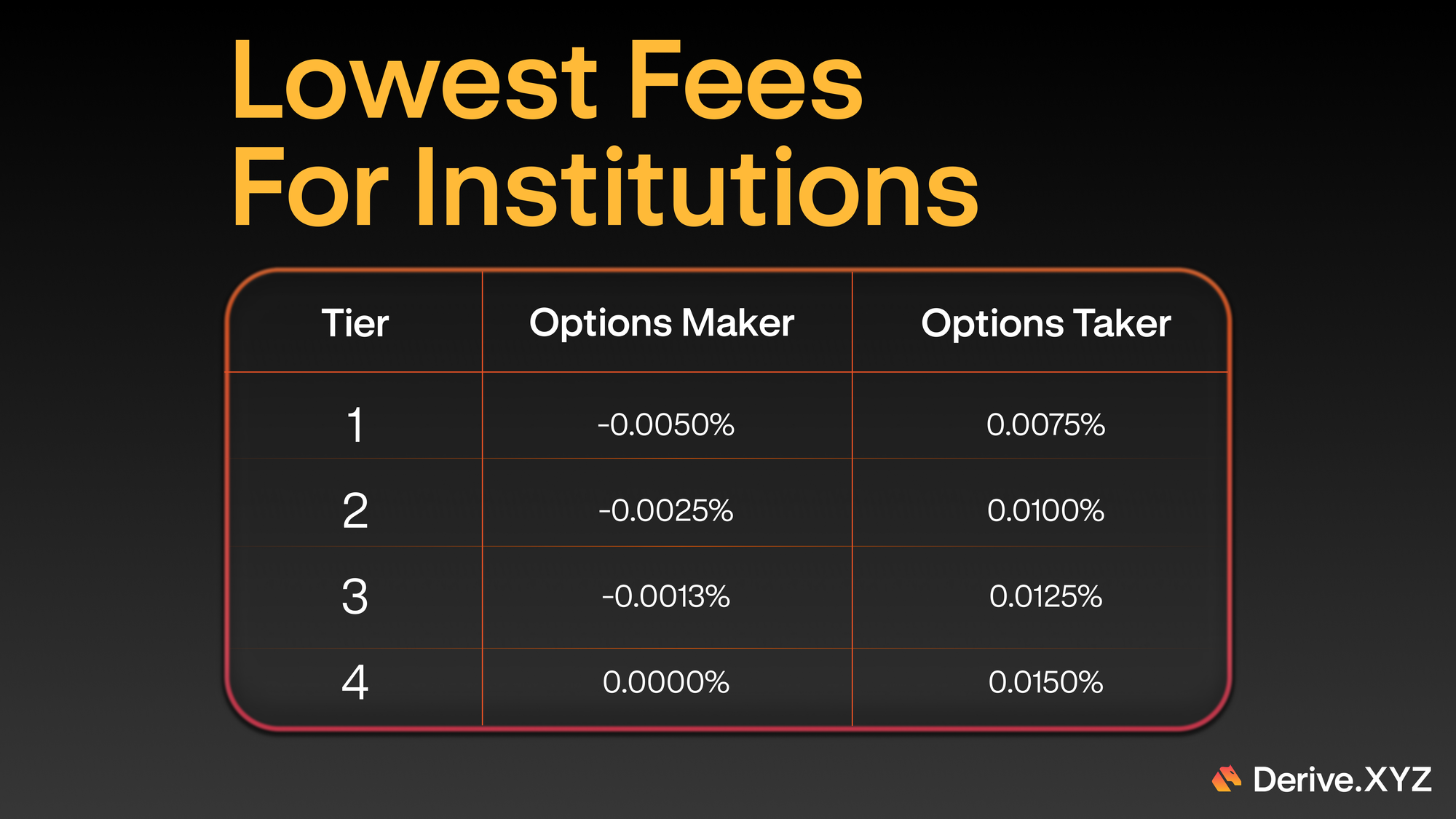

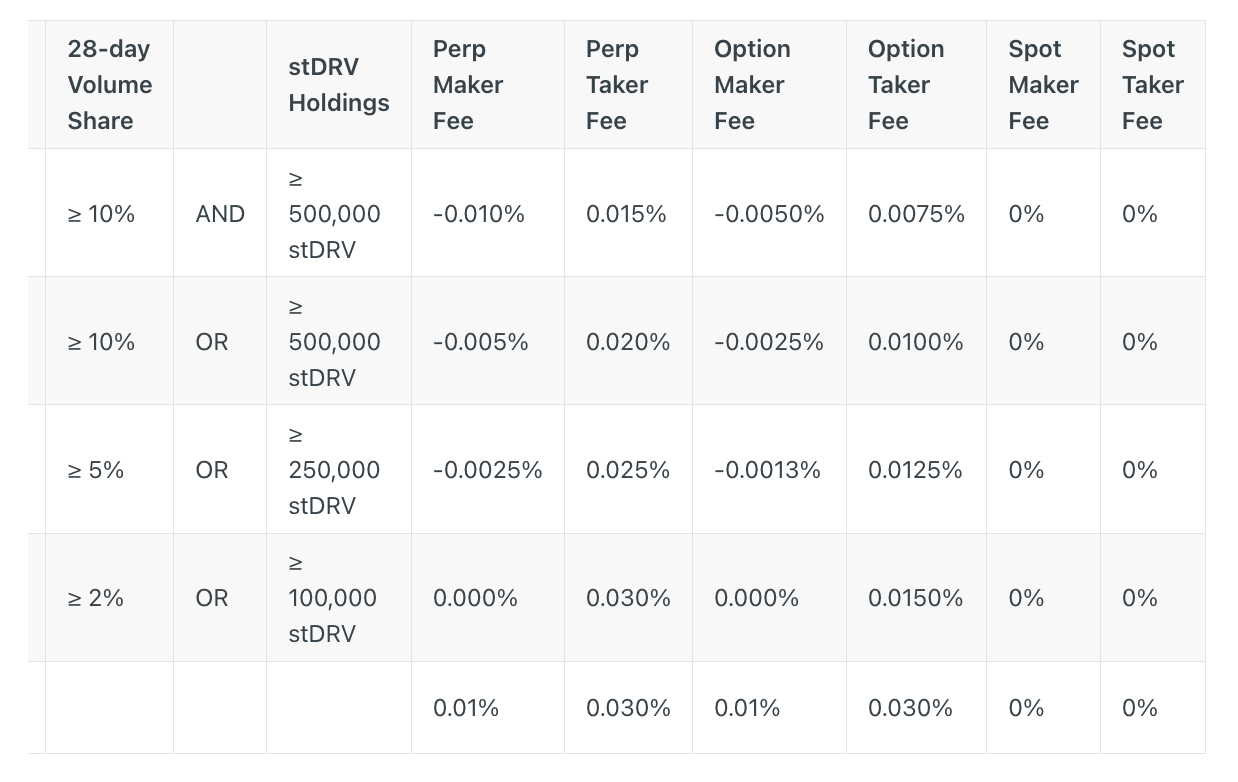

Derive is introducing a simplified options fee model that cuts costs for both makers and takers. The new structure reduces friction for liquidity providers, encourages tighter quoting, and improves execution.

When market makers are rewarded to quote aggressively, traders feel it through better prices, more size at the top of book, and a lower all-in cost of execution. This update is a reflection of our confidence in Derive’s risk engine and our commitment to building the most capital-efficient options venue onchain.

Why?

1. Makers Get Paid to Quote

Top-tier makers can now earn rebates up to -0.005%, rewarding those who keep tight, consistent markets. More aggressive quoting = better spreads and more size on the book.

2. Takers Pay Less

Taker fees now start at 0.0075%, giving directional traders, hedgers, and yield strategies cheaper entry and exit points. Lower taker fees mean lower slippage and better fills.

3. Lower All-In Costs

With compressed fees on both sides, Derive users benefit from:

- Tighter spreads

- Cheaper execution

- Deeper, more stable markets

This update supports our mission to build the most capital-efficient onchain options venue.

Full details at: https://docs.derive.xyz/reference/institutional-trading-rewards-program#/