Episode 7: Incentives, MEV and Institutional Crypto

Crypto OG Hasu joins the podcast as Flashbots Strategy Lead and advisor to Lido and Steakhouse Financial. A former professional poker player turned researcher, he shares insights from early MEV research on Uncommon Core to the current state of liquid staking.

The discussion begins with his entry into crypto and key investment decisions that endured multiple market cycles. It then covers Lido's V3 upgrade for retail and institutional users, the impact of DATs and treasuries on staking, structured products addressing slashing and smart contract risks, and common misconceptions about restaking.

The MEV section explains core concepts, Flashbots' approach to mitigation, ZK-rollup effects on extraction and privacy, and potential privacy tools for large positions. A brief note on ZCash price movements follows.

Steakhouse Financial's role includes DAO treasury management, runway planning, emissions-growth tradeoffs, risk frameworks, and tokenized T-bills for onchain assets.

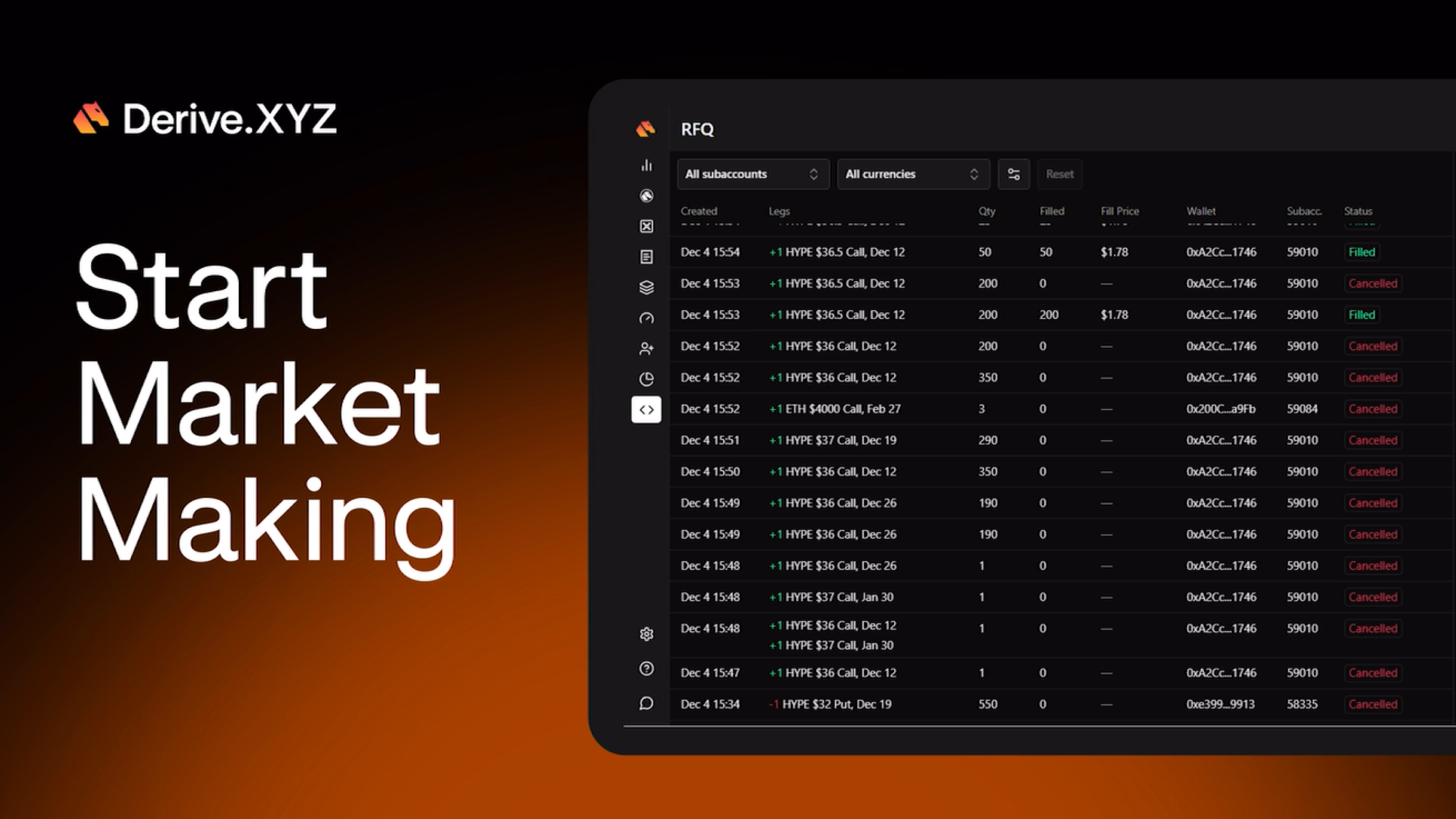

The derivatives discussion examines options market growth over 12-36 months, key barriers, potential breakthrough products, and perpetuals' current dominance. It concludes with Hasu's 2026 outlook and overarching crypto thesis.

Check out the full episode:

Subscribe to our Youtube channel to get the latest updates: https://www.youtube.com/@derivexyz

Follow: Sean Dawson

Follow: Ian randle

Follow: Derive Insights

Trade now: DeriveXYZ

Disclaimer:

The content provided by Derive, including research, podcasts, social posts, and educational materials, is for informational and educational purposes only. Nothing should be construed as financial, investment, trading, or legal advice. Trading and investing in digital assets involve significant risk, including possible loss of capital. Always conduct your own research and consult with a licensed financial advisor before making investment decisions.