Today marks the first time Derive connects directly to the Hyperliquid ecosystem through HyperEVM. With the launch of HYPE collateral, HYPE perpetuals, and RFQ-based HYPE options, Derive now supports the Hyperliquid community without requiring assets to leave HL custody.

This article explains how the integration works under the hood, why it matters for traders, and what’s coming next.

1. The Architecture: Bridge Vault + Escrowed wHYPE

Derive’s integration is built around a Bridge Vault contract deployed on HyperEVM.

This vault is designed to do one thing: hold wrapped HYPE (wHYPE) in escrow and expose the balance to Derive’s margin engine.

Key properties

- HYPE never leaves Hyperliquid. The tokens originate on HyperCore and transfer to HyperEVM, but the underlying liquidity and security guarantees remain native to Hyperliquid.

- No synthetic exposure. Derive does not mint derivatives of HYPE or create a shadow asset. The vault simply escrows wHYPE and proves ownership to Derive.

- Collateral is verifiable onchain. Derive’s risk engine reads the vault state directly, enforcing liquidation logic, margin requirements, and risk checks the same way it does for ETH or USDC.

This keeps trust assumptions minimal while enabling full composability between HyperEVM and Derive.

2. What Can Traders Do?

With escrowed HYPE recognized as collateral, users can now:

1. Trade HYPE perpetual futures.

Market makers are quoting HYPE perps at launch, giving HYPE holders access to directional, hedging, and basis-style trades.

2. Trade BTC/ETH/HYPE options

Holding HYPE and selling call options creates a natural yield strategy for long-only HYPE holders; without ever “unstaking” from Hyperliquid or selling HYPE outright.

Typical annualized premiums on 1M 0.15–0.30 delta calls often land in the 7–15% range depending on implied volatility.

3. Build structured volatility strategies

Because the collateral remains correlated with the underlying, HYPE supports:

- Covered calls

- Cash-secured puts

- Long/short combo spreads

- Delta-neutral vol harvesting

Derive supports Portfolio Margin for HYPE this reduces unnecessary collateral requirements and lowers the probability of adverse liquidations during volatility spikes. As basis yield compresses across markets, yield increasingly shifts toward premium harvesting and volatility capture.

3. How do I try it out?

A full step-by-step user guide is included below, but the flow is straightforward:

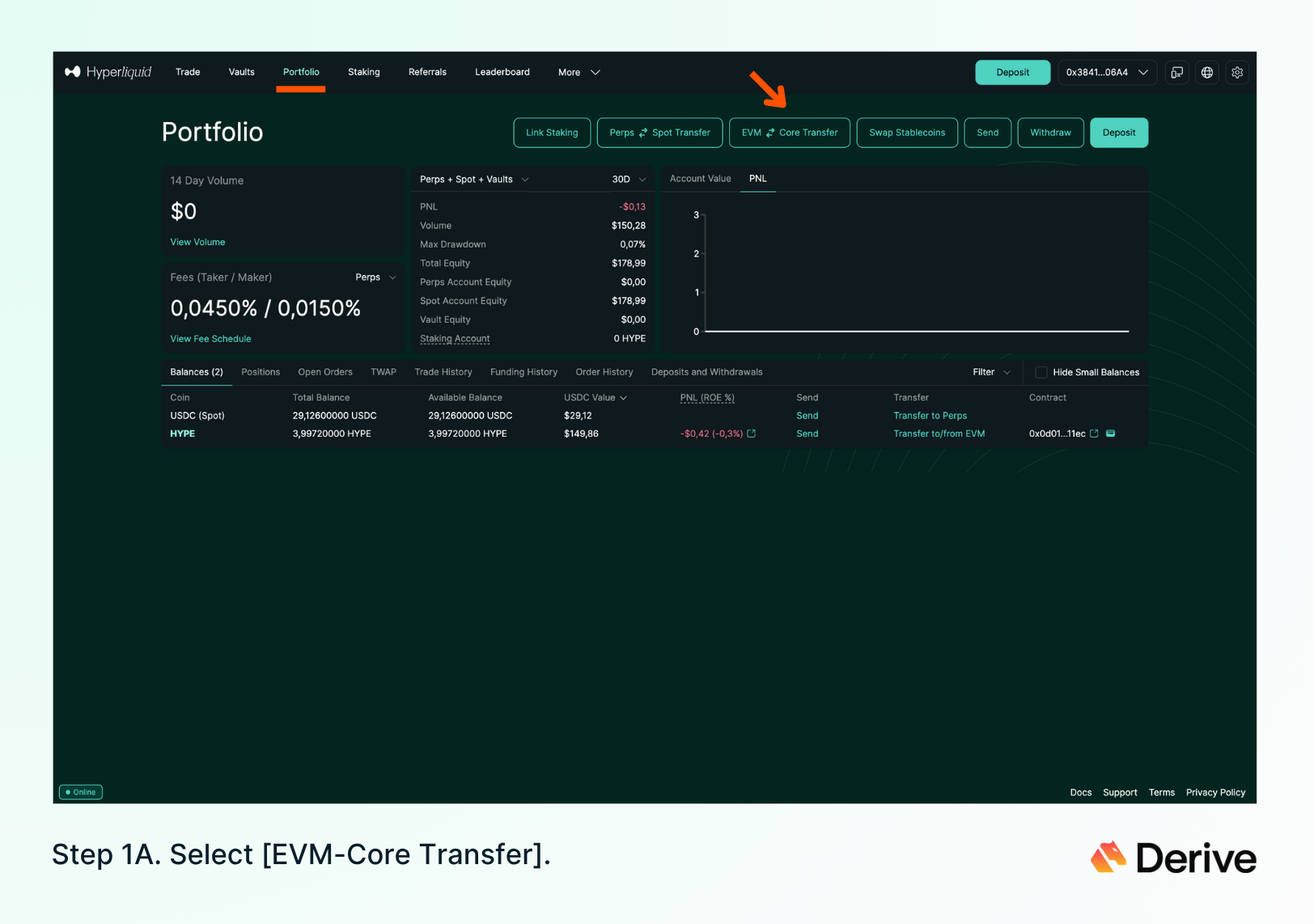

1) Transfer HYPE from HyperCore to HyperEVM. To complete this step, visit the [Hyperliquid web app] and connect your EVM wallet.

a) Open the Portfolio page on Hyperliquid and click EVM-Core Transfer.

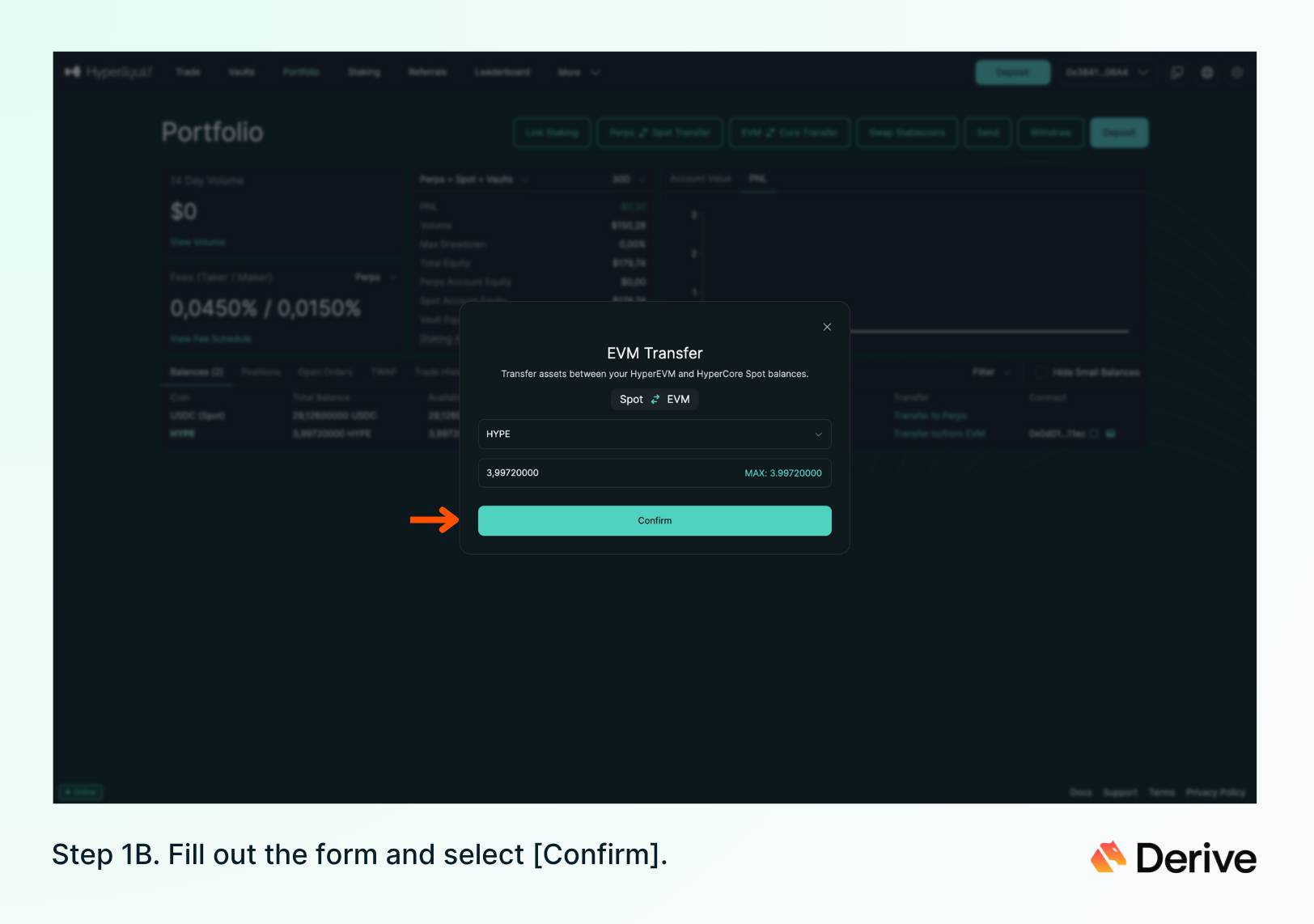

b) Transfer HYPE spot balance from HyperCore to HyperEVM

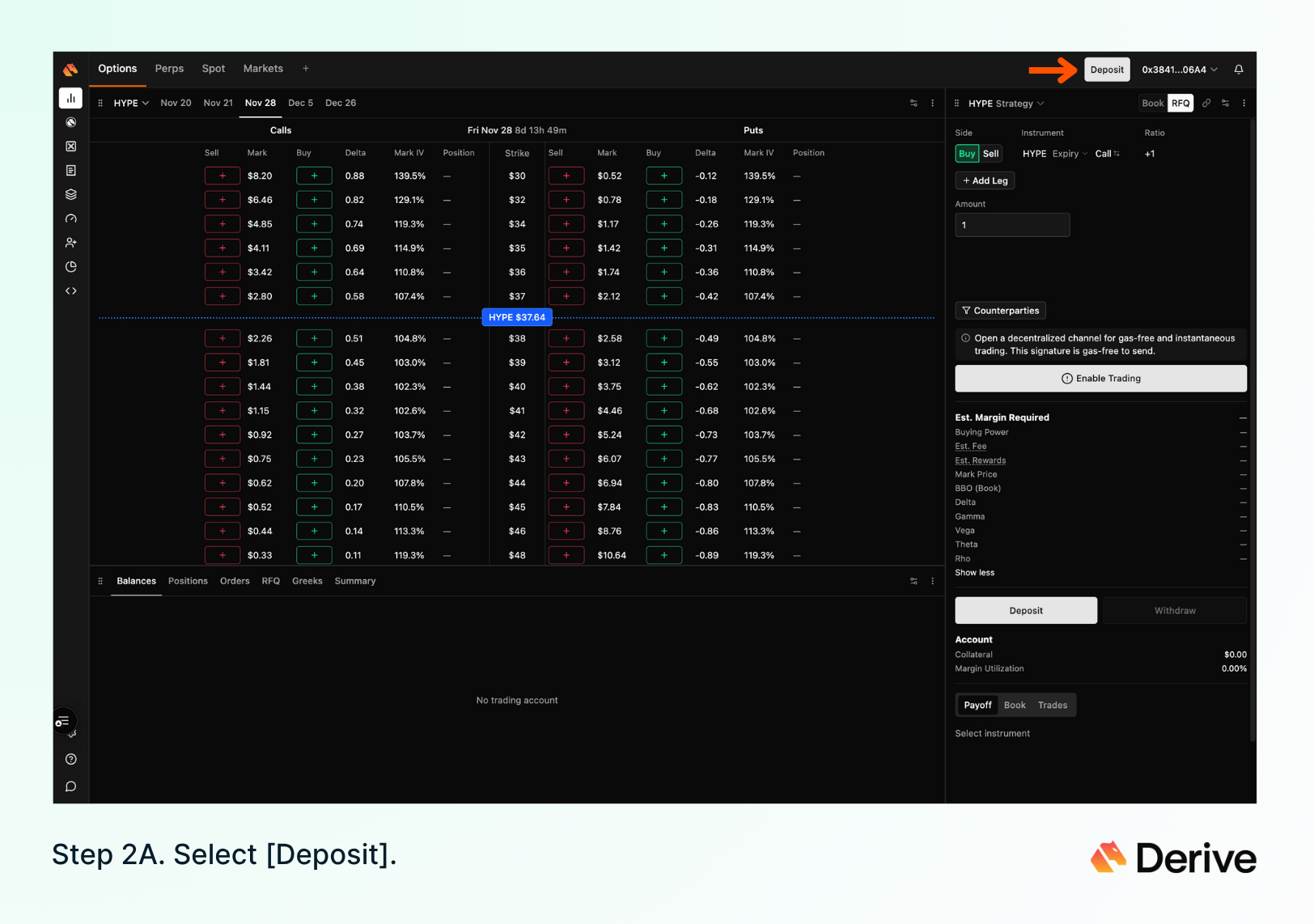

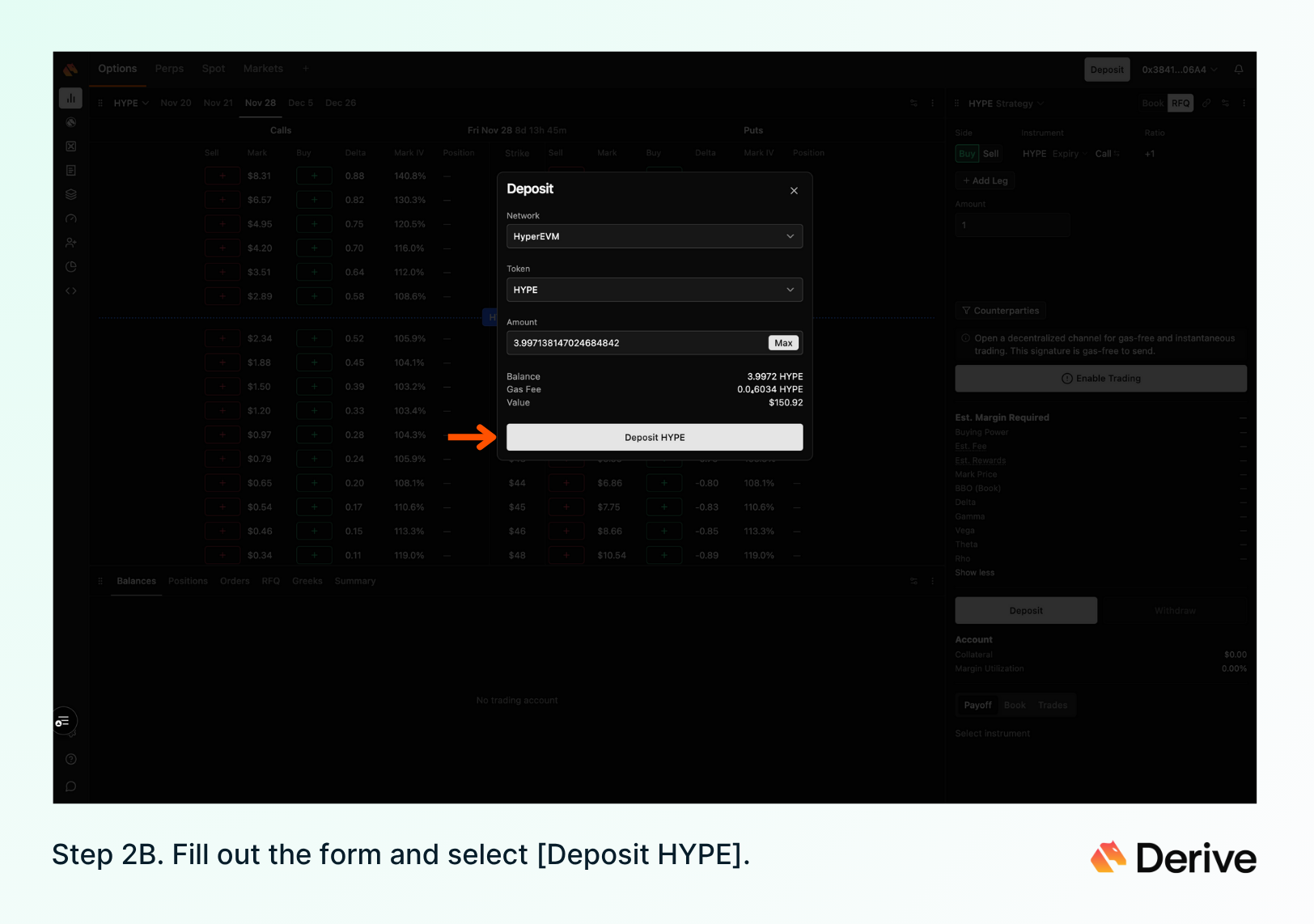

2) Deposit HYPE from HyperEVM into Derive. To complete this step, visit the [Derive web app] and connect the same EVM wallet.

a) In the main navigation bar select [Deposit]

b) Deposit HYPE balance from HyperEVM to Derive.

The first time you deposit, A Standard Margin subaccount is created automatically. You can then create multiple Standard Margin and Portfolio Margin subaccounts (see 3)

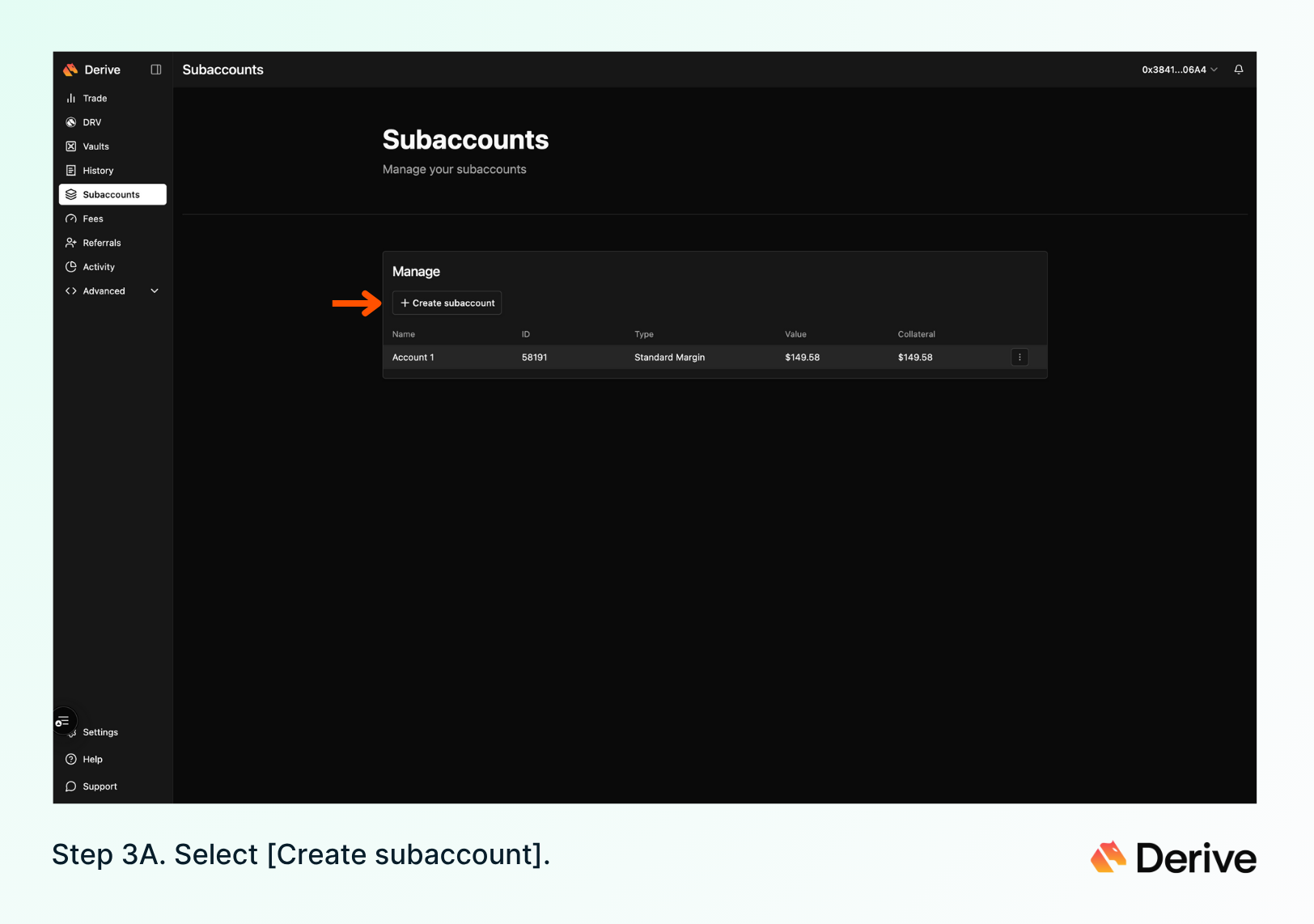

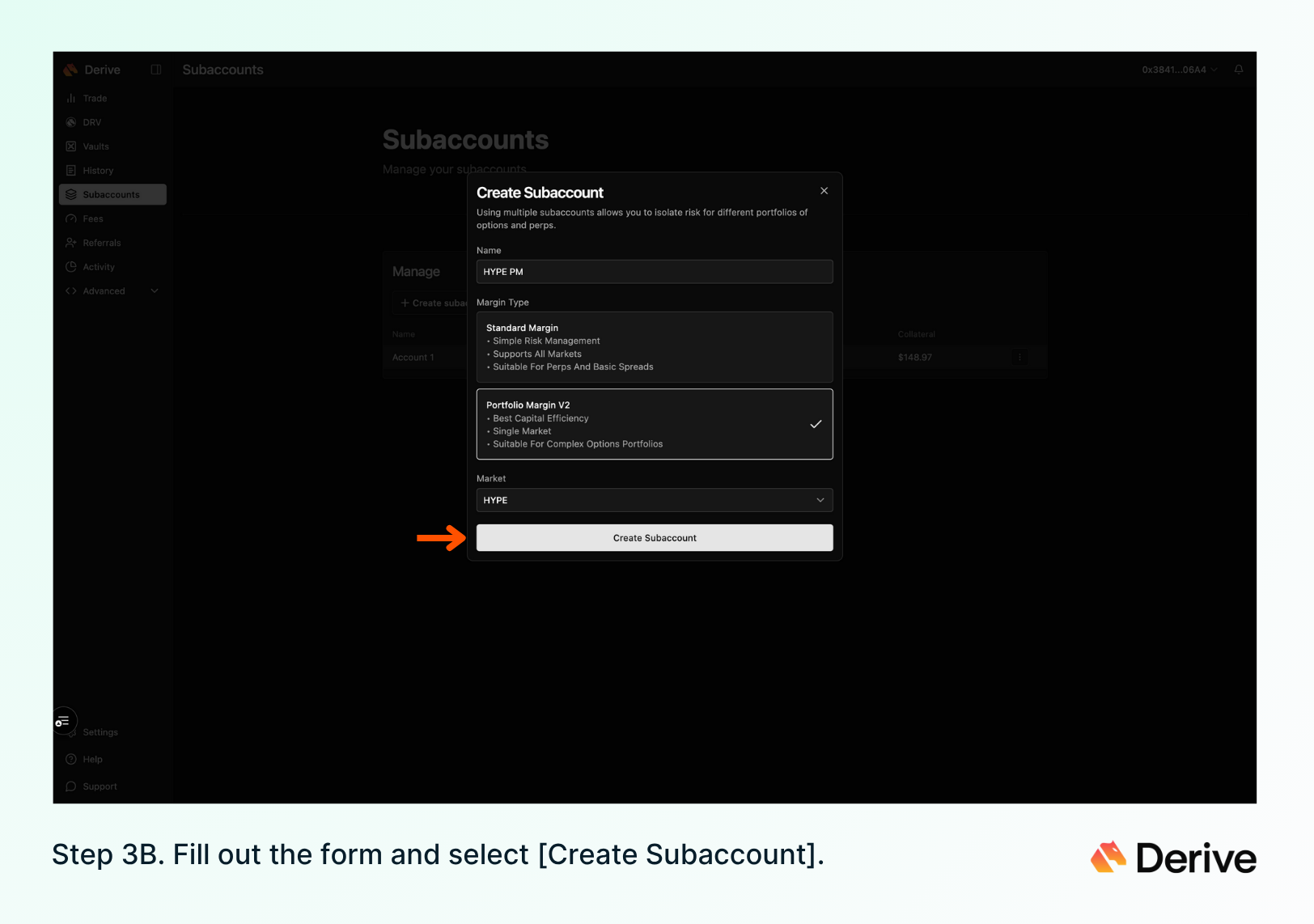

3) Create a HYPE Portfolio Margin subaccount for more efficient margining. (Optional)

a) Navigate to the Subaccounts page and select [Create subaccount]

b) Create Portfolio Margin V2 subaccount for HYPE market.

If you plan to trade spreads, covered calls, or delta-neutral strategies, PM2 is recommended.

Done.

4. What’s Coming Next?

More initiatives will roll out following this launch.

- Short-Dated Options (0–3 DTE) Campaign. This is a natural fit for Hyperliquid traders who already favor high-tempo, event-driven markets. More details will follow in a separate announcement.

- Collaboration with the HypurrCollective Community. We’re working with the HypurrCollective on a dedicated campaign around HYPE collateral.

The Derive–Hyperliquid integration is intentionally simple; assets remain native, security assumptions stay intact, and margining is handled by the same onchain engine that powers billions in notional volume.

Hyperliquid.