We’re excited to announce our partnership with Variant, a leading crypto VC fund. Variant has a significant DRV position through open-market purchases and a foundation transaction, reflecting long-term conviction in Derive.xyz’s trajectory.

Derive.xyz is a leading onchain options exchange with $20B+ in trading volume, where traders, funds, and applications buy and sell options on crypto assets with deep liquidity and institutional-grade execution. Our mission is to make volatility a first-class primitive in onchain markets.

Perpetuals have become the dominant crypto derivatives product. They’re simple, offer high leverage, and are deeply liquid onchain. But perps have structural constraints – liquidation risk, limited payoff design, and funding rate uncertainty.

Where perps fall short, options fill the gap. Liquidation-free leverage and precise volatility exposure make options the superior instrument for long-term positioning and structured risk transfer. While the market has focused on scaling perps, options have remained under-built and under-owned. That imbalance is exactly where we’ve chosen to build.

Until recently, onchain options lacked the infrastructure and liquidity required to scale. That is now changing. Application-specific execution environments have unlocked new markets, and liquidity, market-making, and onchain price discovery are following.

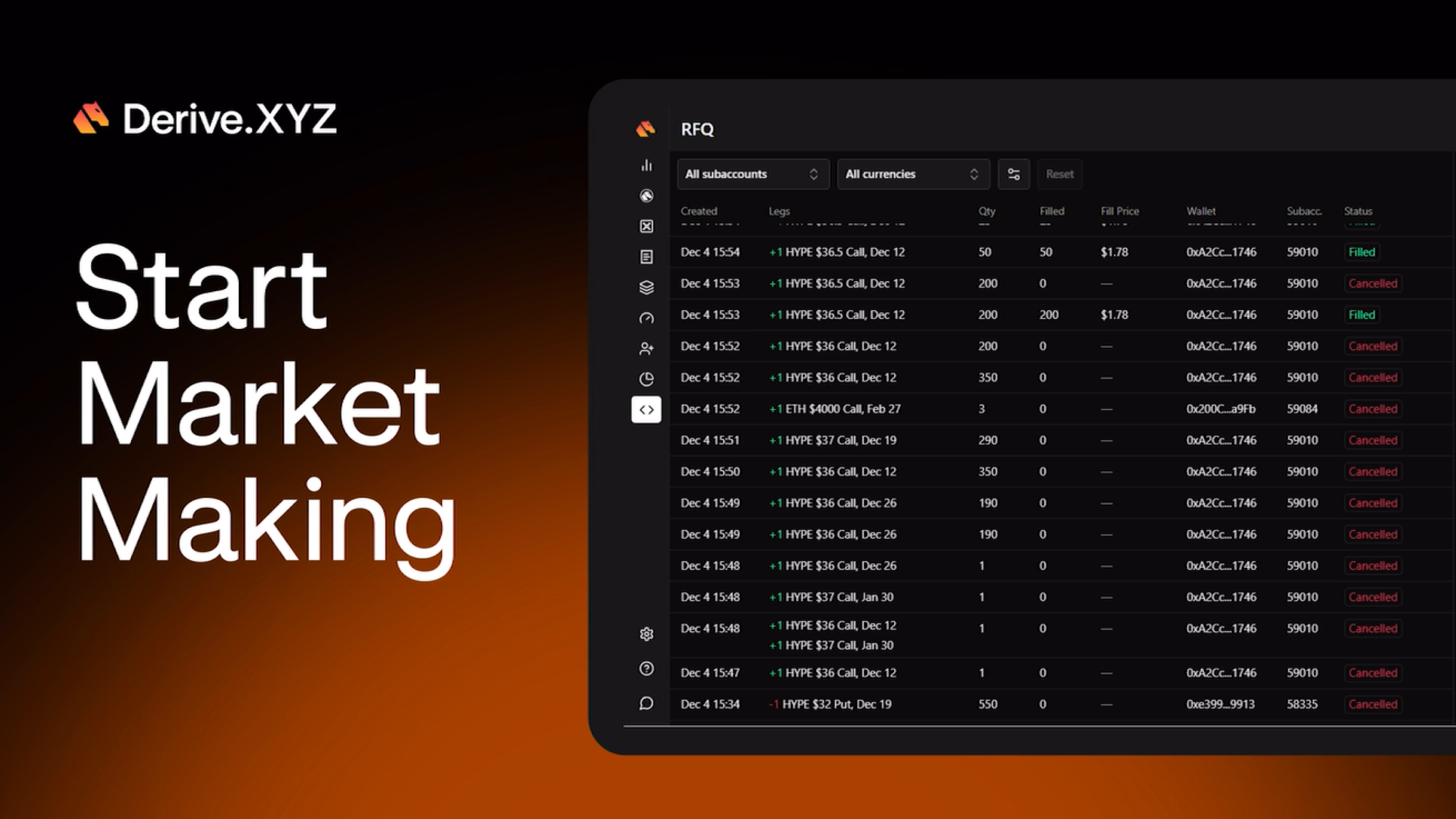

Over the past five years, Derive.xyz has become a core venue for onchain options trading and volatility products. Today, more than 20 teams build on Derive across interfaces, structured products, and trading infrastructure. The metrics speak for themselves:

- $20B+ in trading volume and $7M+ in revenue

- Won the HYPE options market within 2 months of launching, over $100M+ notional traded so far

- Deep liquidity following a 2024 market-making partnership with FalconX

- 5 years live with zero security or insolvency incidents.

Institutional Access

Derive.xyz has made it possible for institutions to participate in onchain volatility strategies without changing their custody or compliance posture.

Through an off-exchange custody integration with Strands, institutions can trade directly on Derive while assets remain with their existing regulated custodian. Execution occurs onchain, while custody stays offchain. This removes smart contract and bridge risk and addresses the custody requirements of regulated funds and treasuries.

While onchain options remain a small share of global derivatives volume today, Derive already accounts for the majority of onchain options open interest and activity.

As liquidity, market makers, and integrators converge on shared venues, network effects in options markets strengthen. Derive is well-positioned to benefit from this dynamic.

What Comes Next

Our 2026 roadmap is focused on expanding institutional participation: adding off-exchange custody integrations with major custodians, establishing compliant access pathways for regulated capital, and launching altcoin options to extend beyond majors into the broader crypto asset universe. If any of those interest you, please reach out to hitesh@derivelabs.xyz.

With Variant’s partnership, we’re entering the next phase of scaling Derive’s liquidity, integrations, and institutional adoption.