October 10, 2025 By Dr. Sean Dawson

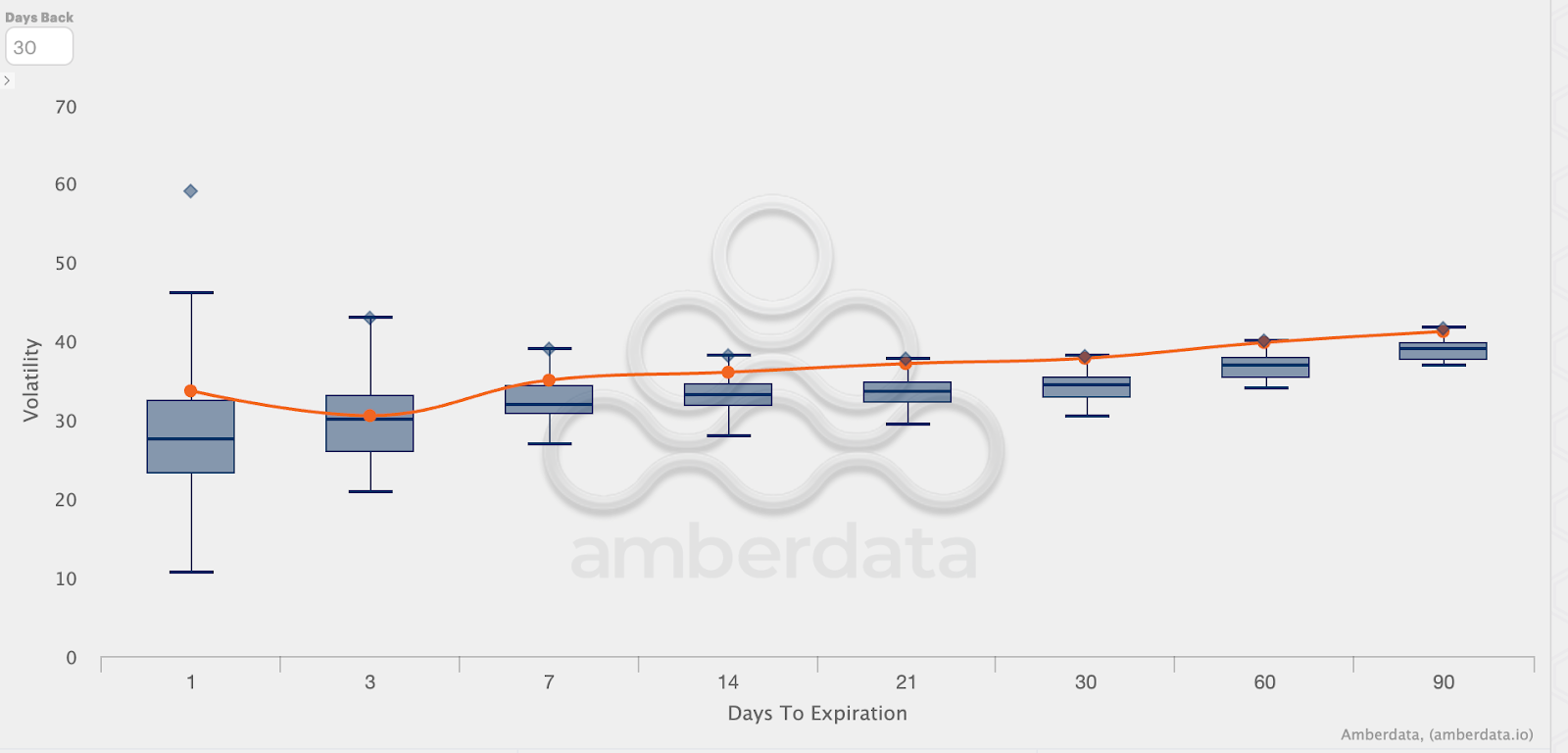

Bitcoin volatility is poised for a breakout. Implied volatilities across 14, 30, and 90-day expiries have surged to their highest levels in the past 30 days, pointing to increased anticipation of big moves ahead.

Term structure of BTC volatility with box plots overlaid to highlight historical ranges

Source: Derive.xyz, Amberdata

This spike comes as markets price in a near-certain 25 basis point rate cut by the Federal Reserve later this month, with Polymarket odds currently sitting at 90%.

Following a 3% dip from $123K to $120K, BTC has recovered to $121.6K. According to Coinglass data, a dense band of short positions is at risk of liquidation just above this level. A modest push upward could trigger a cascade of liquidations and propel BTC back toward $125K and beyond.

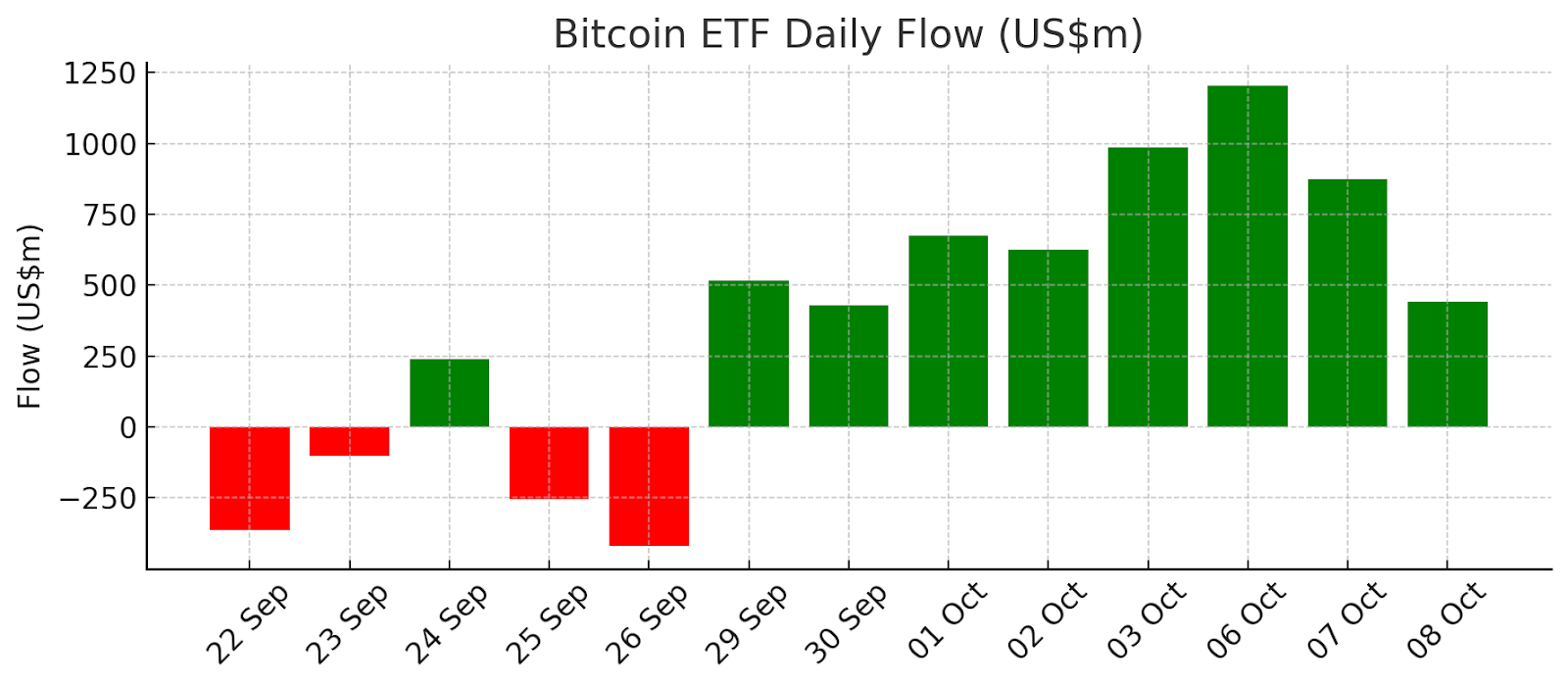

BTC ETF inflows have remained solid throughout the past week, indicating strong institutional demand. ETH has mirrored this trend with sustained inflows, suggesting a broadly bullish macro backdrop heading into October.

BTC ETF inflows over the last 2 weeks

Source: Derive.xyz

On Derive, traders are positioning for a significant upside move. A large cluster of BTC call options for the October 31 expiry is concentrated around the $128K and $145K strikes, pointing to bets on a $150K+ move before month’s end.

ETH is seeing similar enthusiasm, with call open interest focused on the $5K and $6K levels, reflecting strong sentiment for an “Uptober” rally across the majors.