September 3, 2025 By Nick Forster

With rates expected to fall and institutions stockpiling ETH, markets are setting up for explosive potential heading into Q4.

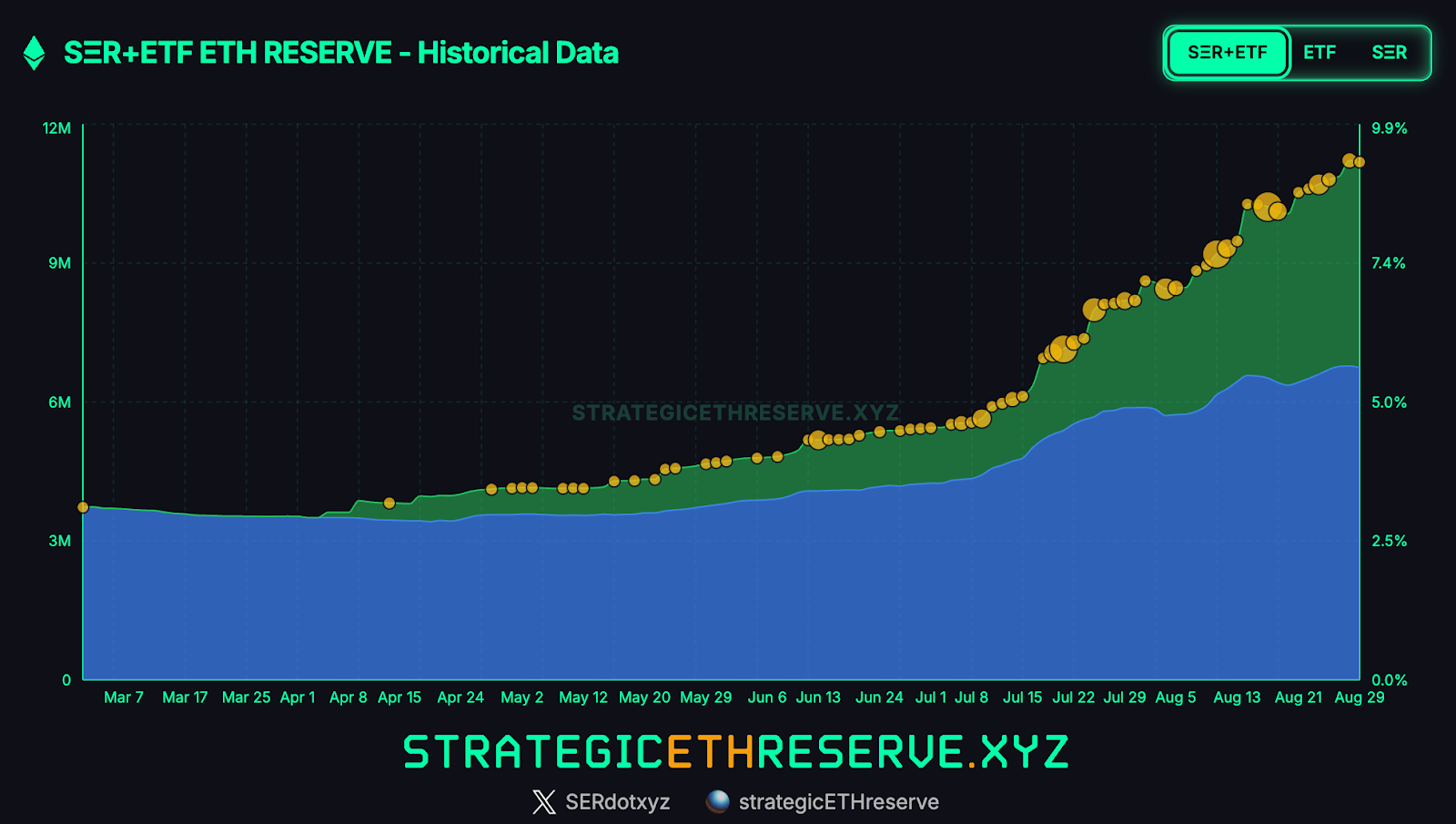

Institutional adoption of ETH is building serious momentum. Last week alone, the number of ETH held by ETFs rose by 250K – from 6.5 million to 6.74 million (recorded here). But more notably, strategic ETH reserve (SER) companies like Bitmine (+78.8K on August 28) and Sharplink Gaming (+56.5K on August 26) added a combined 330K ETH – 33% more than ETFs over the same period.

SERs now hold nearly 4% of the total ETH supply and are rapidly catching up to the 5.5% held by ETFs. With rates expected to decline, we could plausibly see SERs holding 6-10% of ETH’s supply by year-end, positioning them as a major force behind ETH’s price action.

ETH held by ETFs and strategic ETH reserves

Source: Strategic ETH Reserve

Derive’s recent partnership with ETH Strategy, a DeFi-native treasury protocol modelled on MicroStrategy, reflects this trend, offering institutions new infrastructure to generate USD-denominated yield from ETH while maintaining long exposure. The vault is expecting $20 million in stablecoin commitments at launch, with demand for ETH-native yield products from institutional allocators.

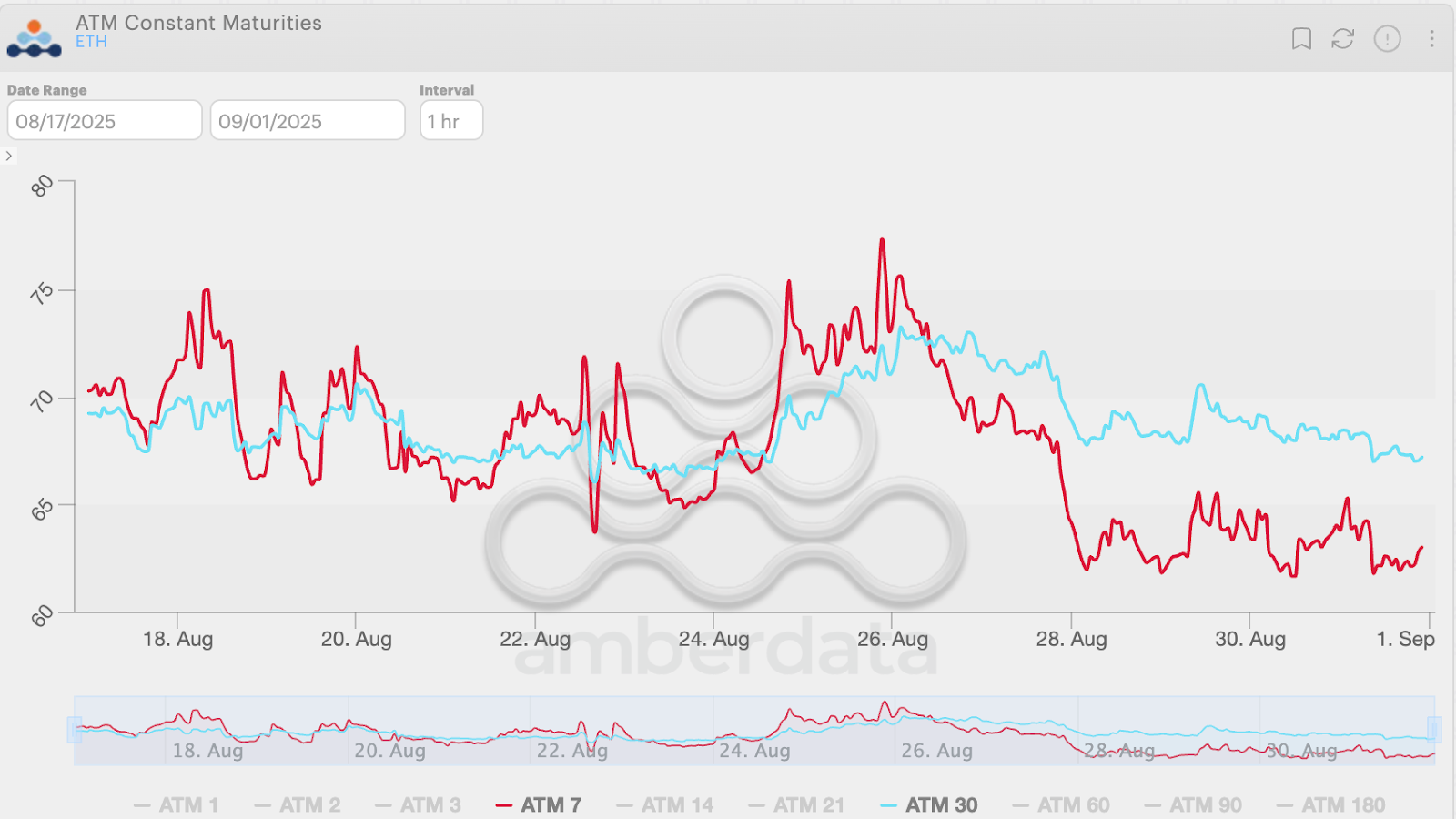

In the options market, short-term ETH volatility has dropped sharply – from 75% to 63% over the past week – suggesting the market is pricing in a steadier, more gradual rally.

ETH ATM volatility over the last 2 weeks

Source: Derive.xyz, Amberdata

Price Predictions

There’s a 7% chance of BTC hitting $150K by the end of October (down from 14% last week) while there’s a 22% chance by year-end. For ETH, there’s a 30% chance of it reaching $6K by the end of October (down from 45%), and a 44% chance by year-end.