September 19, 2025 By Nick Forster

The FOMC cut rates as expected today, and while the initial market response was reserved, momentum quickly picked up.

BTC and ETH are up 1.7% and 3% respectively over the last 24 hours. Hyperliquid’s $HYPE surged nearly 7% to a new all-time high of $59.30, reflecting renewed speculative appetite amid a lower-rate environment.

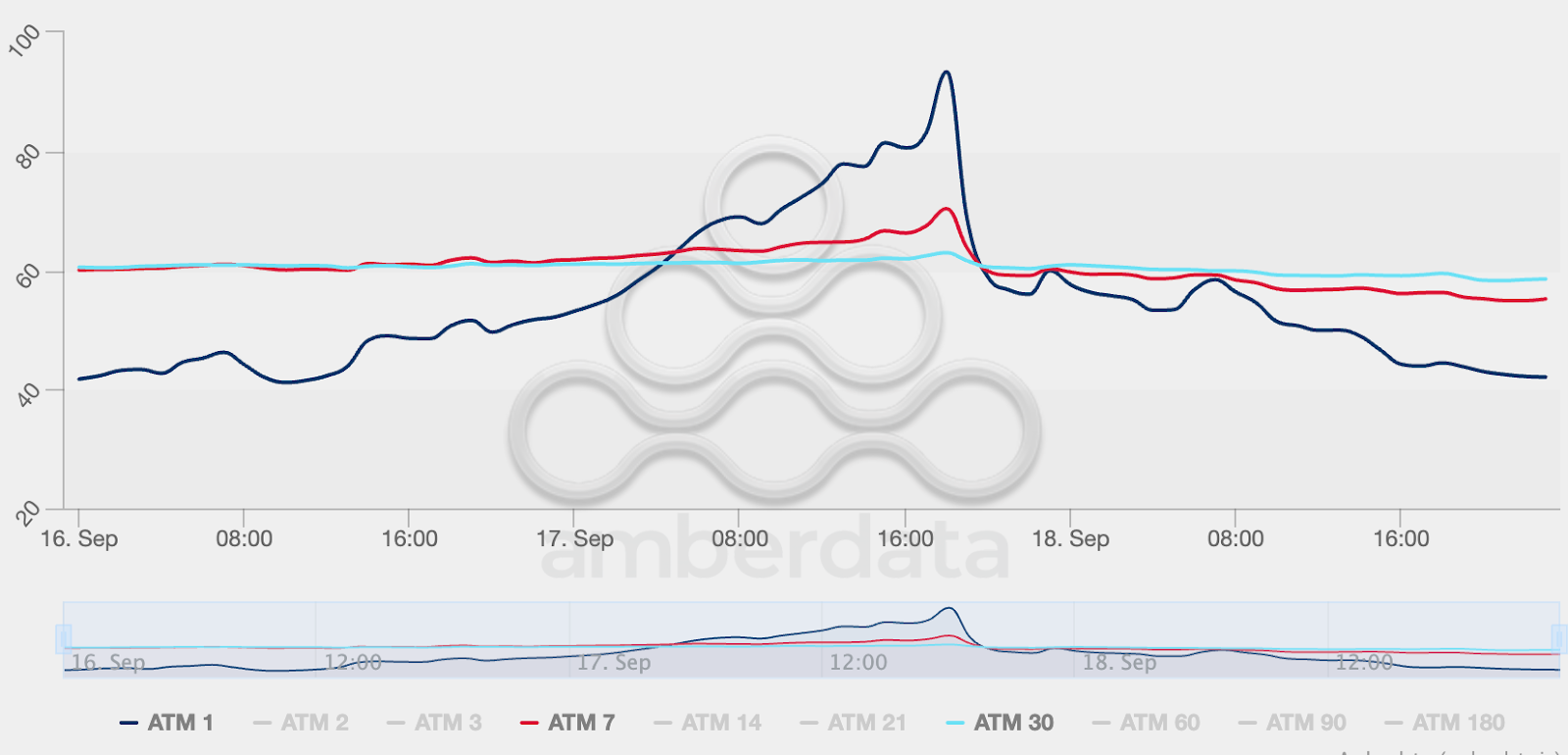

Short-dated ETH volatility collapsed from 92% to just over 40% following the Fed’s decision, with BTC volatility seeing similar declines.

Short dated volatility for ETH, 7 and 30 day vol

Source: Derive.xyz, Amberdata

Meanwhile, RSI signals suggest AVAX and NEAR are in overbought territory, both exceeding 70 on the 14-hour chart. ETH and BTC remain more stable at RSI 50 and 47 respectively.

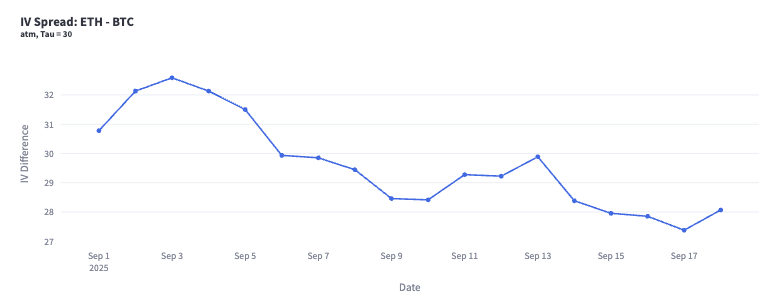

ETH/BTC 30-day volatility spread has dropped 10% since the start of October, hinting that volatility – and attention – may rotate back toward BTC as macro conditions continue to favour risk assets.

ETH-BTC ATM volatility spread

Source: Derive.xyz, Amberdata

Options markets tell a clear story. For ETH October 31 expiry, heavy call activity is clustered around $4.5K, $5K and $5.2K strikes, signaling traders are betting on a 10-15% surge.

For BTC, nearly half of all open interest is at the $115K strike, with the remainder spread across $130K and $150K, suggesting Derive.xyz traders are leaning aggressively bullish heading into month’s end.