October 21, 2025 By Dr. Sean Dawson

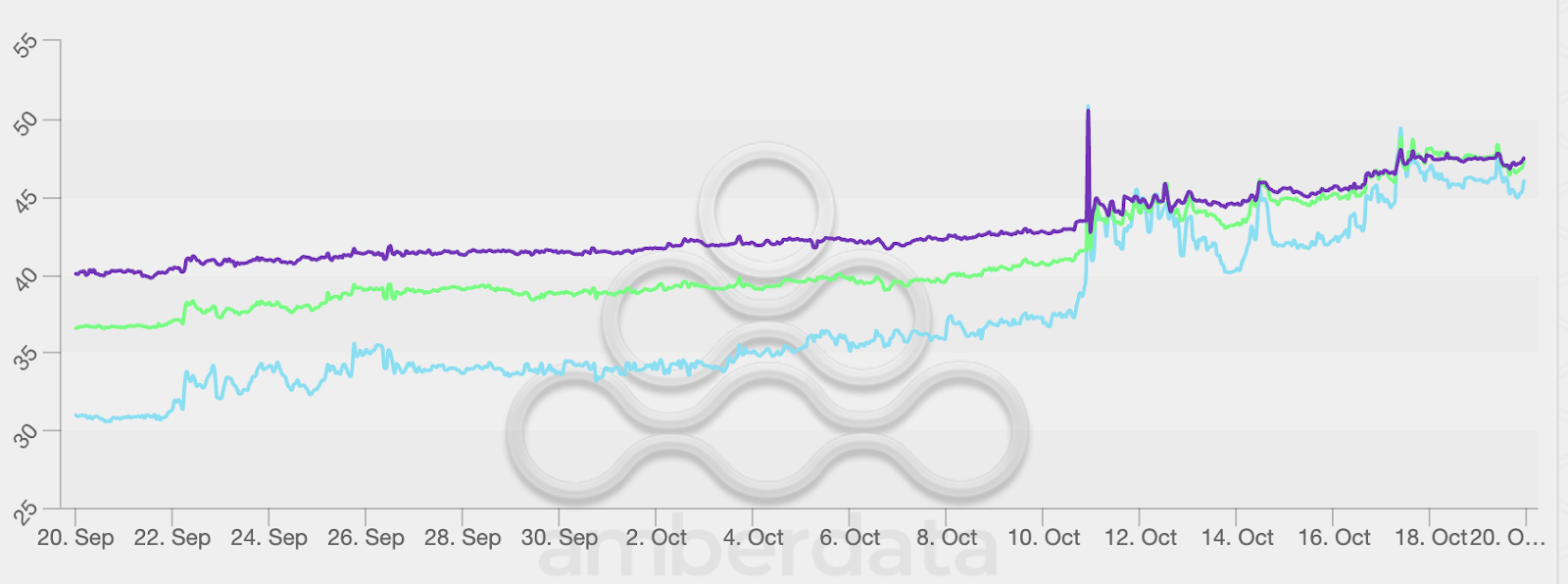

Volatility is heating up across BTC and ETH as markets grapple with fears of a renewed U.S.-China trade war and a bursting AI bubble. 30-day implied volatility for BTC has surged to 45%, up from 30% a month ago, while ETH has jumped from 57% to 72% over the same period.

BTC IV for 30/90/180 day expiries (blue, green, purple)

Source: Derive.xyz, Amberdata

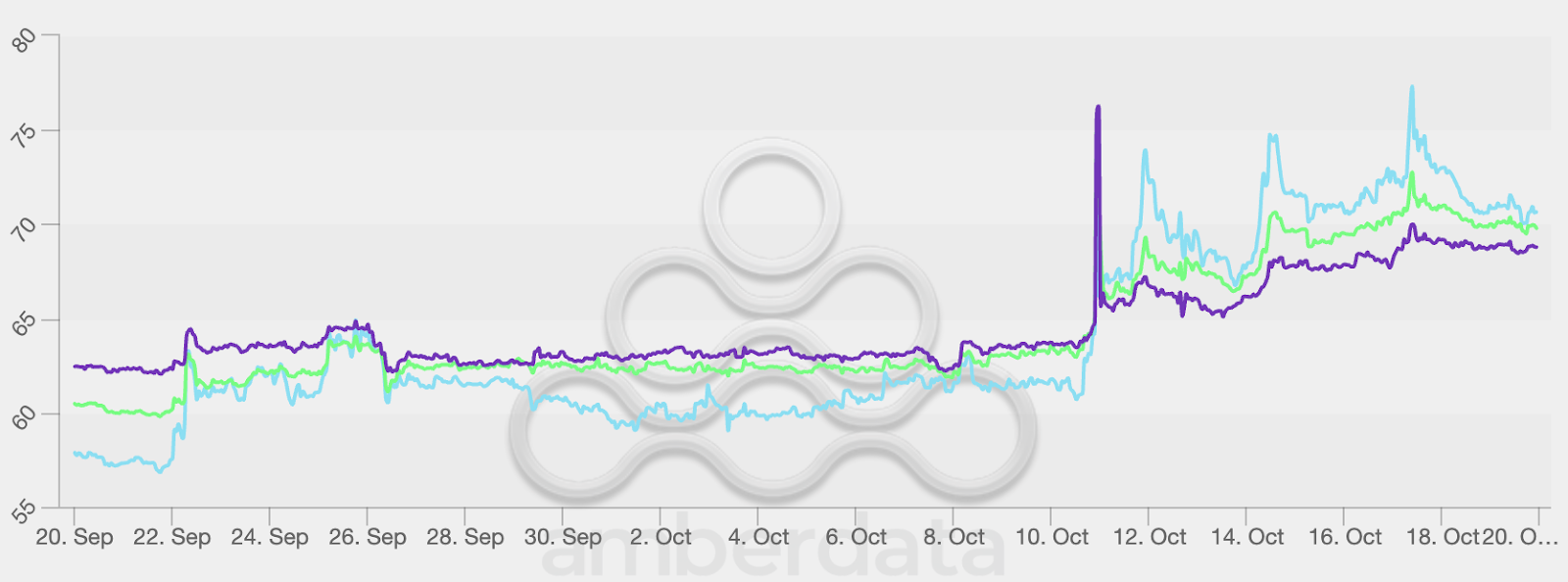

Longer-dated contracts are showing similar stress. BTC’s 90 and 180-day vols have both risen from 36% and 40% to 47%, while ETH’s have lifted from 60% and 63% to 71% and 68% respectively.

This shift suggests traders are increasingly bracing for sustained turbulence. The major price swings seen earlier in October, coupled with mounting macro uncertainty, have shaken confidence across digital asset markets.

ETH IV for 30/90/180 day expiries (blue, green, purple)

Source: Derive.xyz, Amberdata

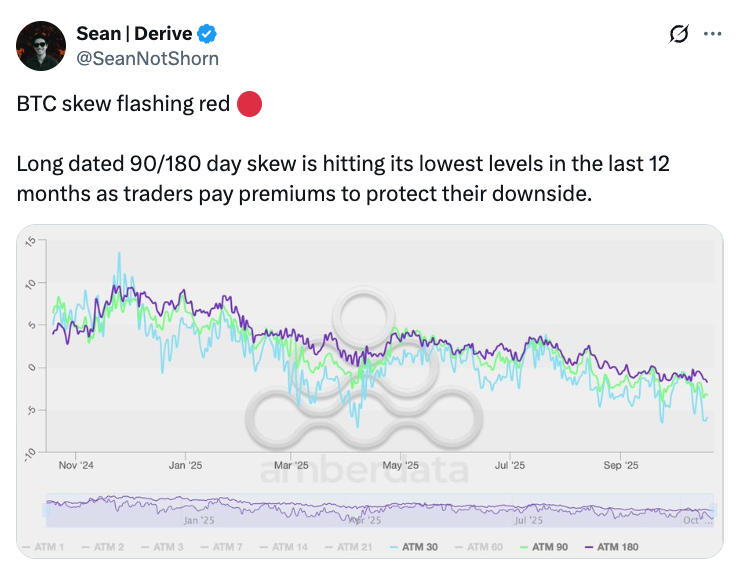

Adding to the caution, BTC 90/180-day skew has hit its lowest level in 12 months, signaling elevated demand for downside protection. Despite BTC’s steady price performance, traders are clearly hedging against the risk of deeper drawdowns.

https://x.com/SeanNotShorn/status/1980034179745386879

Still, not all is bleak. Fedwatch now places the odds of a 25 basis point rate cut on October 29 at 99%. Lower rates could drive renewed inflows into risk assets like crypto as investors hunt for yield – a potential tailwind that could offset the current volatility spike.”