September 9, 2025 By Dr. Sean Dawson

Crypto markets are holding steady as traders await this week’s U.S. CPI data, due September 11. The delay comes after last week’s disappointing jobs report, which showed just 22,000 jobs were added to the U.S. market in August – well below expectations – alongside an unemployment rate rising to 4.3%.

These weak economic signals have shifted rate expectations sharply. According to Polymarket, the odds of a 50 basis point rate cut have jumped from 10.1% late last week to 16% today. The probability of no cut remains flat at 3.5%.

Volatility reacts to new rate outlook

Markets appear to have priced in the increased likelihood of rate cuts. Short-dated ETH volatility has risen from 34% to 51% since Friday. However, this remains lower than the weekly implied volatility (65%), suggesting that traders expect muted price action around CPI, but more movement on broader macro timeframes.

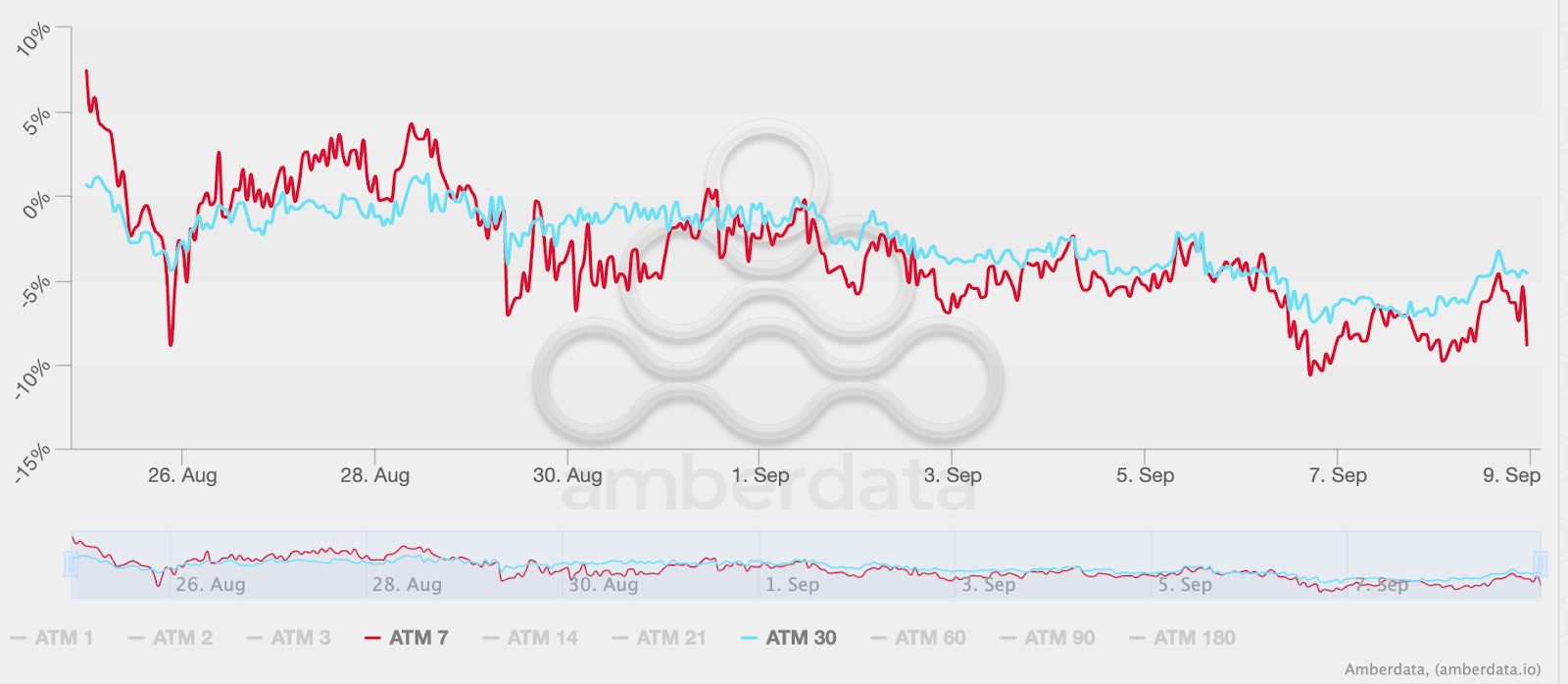

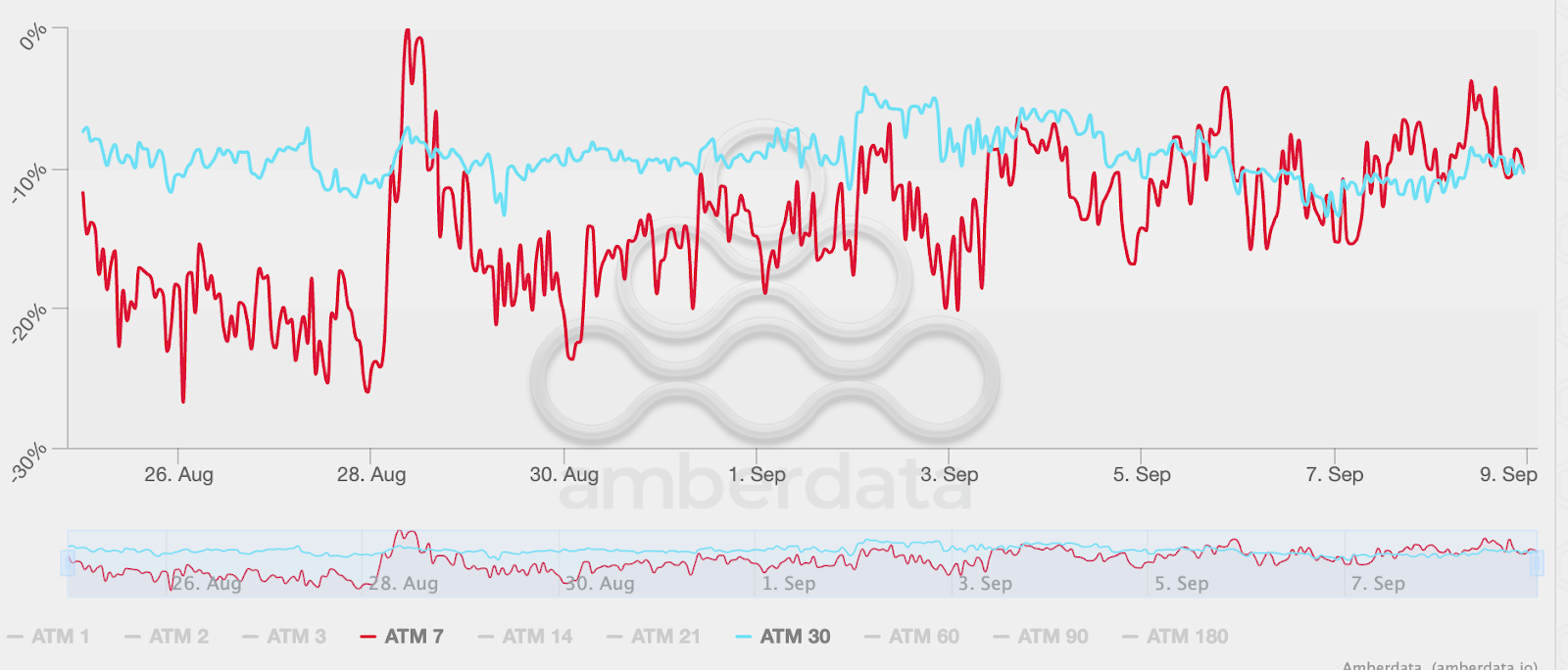

Skew signals growing demand for downside protection

At the same time, ETH and BTC skew have been trending downward across both 7 and 30-day tenors, a sign that traders are buying more puts and seeking protection amid growing macro uncertainty.

ETH skew for 7 and 30 day tenors

Source: Derive.xyz, Amberdata

BTC skew for 7 and 30 day tenors

Source: Derive.xyz, Amberdata

Price Predictions

There’s a 20% chance ETH will fall below $3.5K (slightly up from 18% last week), while there’s also a 20% chance BTC falls under $100K (slightly up from 19%).

Looking ahead to the end of the year, there’s a 23% chance BTC will reach above $140K (up 2%) and a 23% chance ETH will reach over $7K (unchanged).