September 15, 2025 By Dr. Sean Dawson

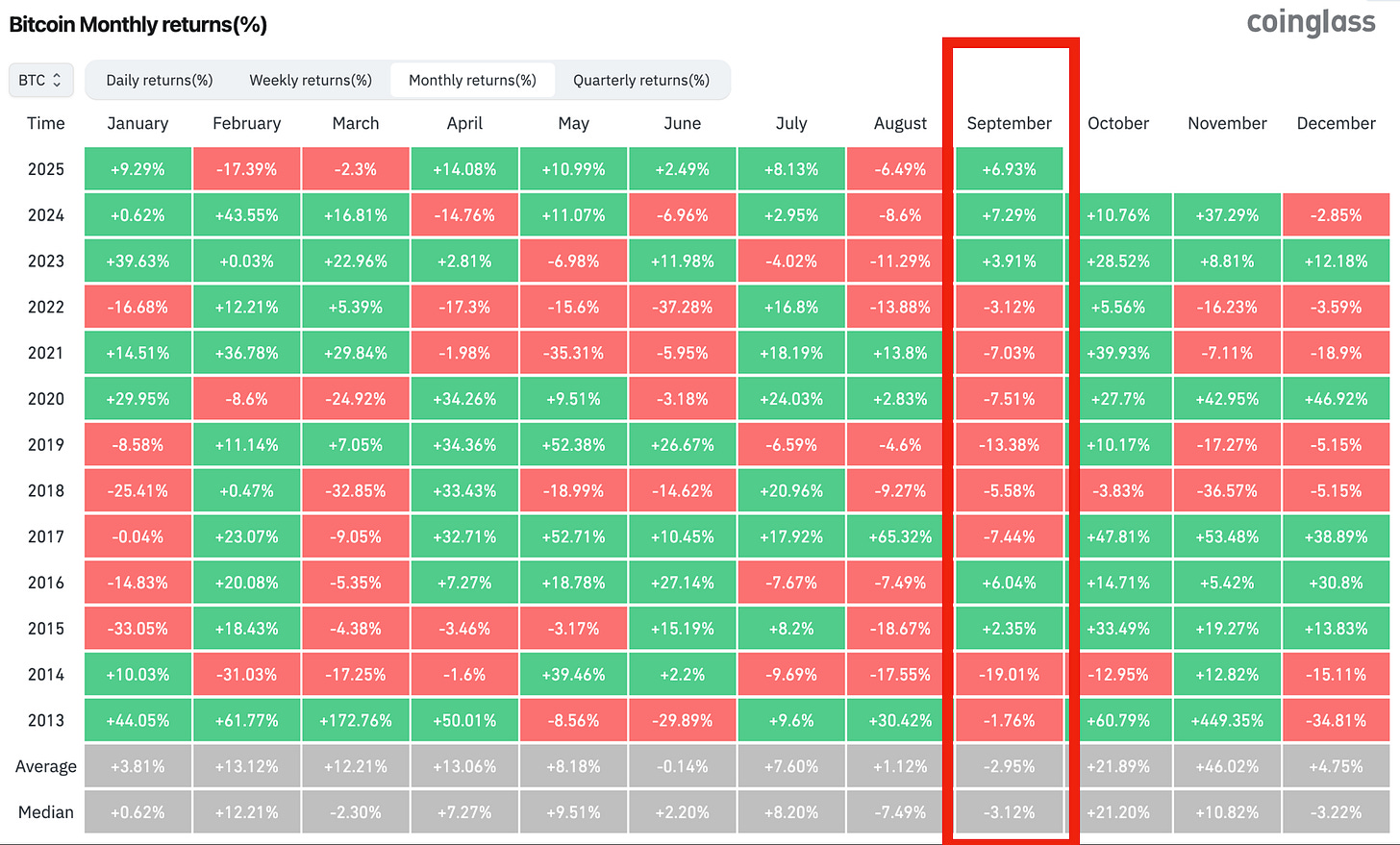

There’s been growing speculation that we’ve reached the top of this cycle but I don’t think that’s the case. Yes, the coming weeks could bring increased volatility and some short-term pain, particularly in September, which has historically been a tough month for crypto.

On average, BTC returns -2.9% in September, largely due to natural selling pressure around the U.S. financial year-end. We’re already seeing signs of that pressure in the data.

Historical performance of BTC by calendar month

Source: Coinglass

ETH-denominated asset treasuries (DATs) like Bitmine and Sharplink Gaming are a good example. Over the past month, we’ve seen their mNAVs – their market value relative to the ETH they hold – drop below 1. Bitmine has fallen from 9+ in mid-July to 0.95 today, while Sharplink Gaming has dropped from 1.53 to 0.88.

When mNAV is above 1, these companies can issue new shares, buy ETH, and grow their treasury – positive for ETH prices. But when mNAV drops below 1, there’s a strong incentive to sell ETH and buy back shares instead. We’ve seen this play out already with ETHZilla’s announced share buyback. This “self-arb” behaviour can create headwinds for price in the short-term.

That said, this isn’t the end of the road, it’s more like a breather. In fact, I’d argue we’re only halfway through what could be a very powerful Q4 rally.

Macro is turning extremely favourable. The latest Polymarket data shows the odds of three rate cuts before year-end have jumped from 22% to 49% in just two weeks. Even the chance of four cuts – equivalent to a 100 basis point slash – is now over 10%. That’s a massive shift in expectations, and one that typically supports “risk-on” assets like crypto.

Rate cut odds for the rest of 2025

Source: Polymarket

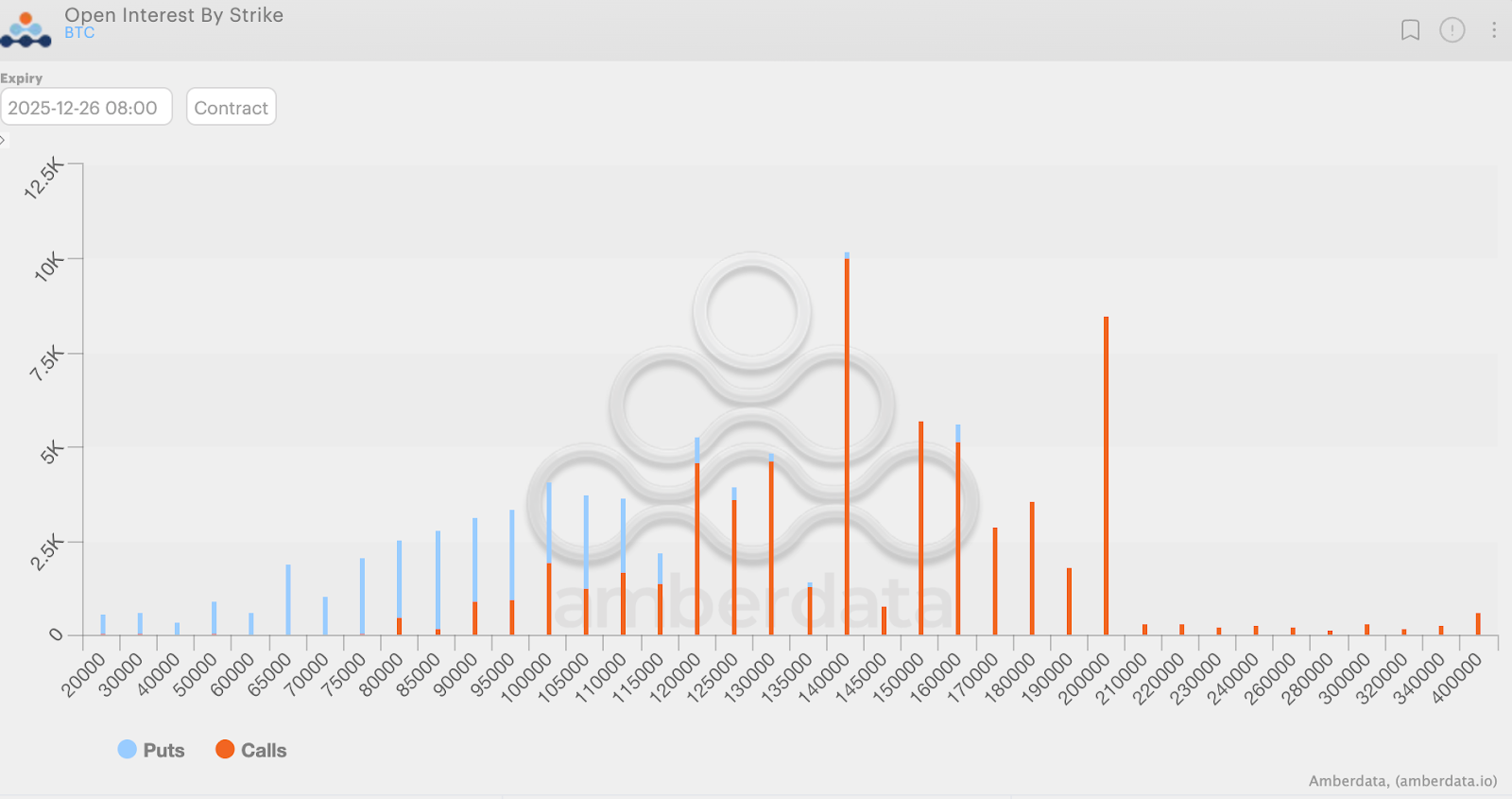

Meanwhile, options markets are showing sustained bullish sentiment. For BTC, open interest is stacked around $140K, $150K, $160K and even $200K strikes for the December 26 expiry. Call open interest outnumbers puts nearly 2.5 to 1 (64K vs. 26K). For ETH, there’s a broad spread of bullish strikes from $4K to $7K.

That positioning matters – option boards let us derive the market’s consensus probability of price outcomes. And right now, they’re saying there’s a 40% chance ETH closes above $5K by year-end, and 20% chance it settles above $6K. For BTC, the market gives a 37% probability of $125K or higher by the same time.

BTC OI for the 26 DEC expiry

Source: Amberdata

In short, while some are worried that 'the music is about to stop,' the reality is more nuanced. We may see volatility and consolidation in September, driven by fiscal year-end flows and some profit-taking among ETH DATs. But the structural backdrop – falling rates, institutional positioning, and bullish derivatives markets – suggests there’s still substantial upside ahead. This is likely not the cycle top.